Officials in both the USA and CSA were remarkably successful in finding sufficient financial resources to support their armies in the field for the better part of four long, bloody years.

~ Introduction ~

~ Introduction ~

By the time of Abraham Lincoln’s inauguration as President of the United States (USA) in March 1861, seven seceding Southern states had already formed the Confederate States of America (CSA). Political leaders throughout that territory, as well as most of their counterparts in the Northern and Border states, believed that any period of fighting to establish the legitimacy of the new Confederate nation would be rather short. Neither of the newly appointed Secretaries of the Treasury in the USA (Salmon Portland Chase) or the CSA (Christopher Gustavus Memminger) expected to have to raise several billion dollars to prosecute a four-year-long war. As they approached the task of financially supporting even a short war, both men understood that nations had traditionally used three major sources to finance their wars: borrowing money, printing money, and raising money through taxation. From 1861 to 1865, both the USA and the CSA used each of these mechanisms, although in different and varying proportions. Historical sources differ a bit on the exact percentages of their wartime expenses those territories raised from various sources. However, the following table incorporates several estimates from scholars using different assumptions about inflation, currency values, and definitions.

In many ways, describing these financing activities reveals a tale of two countries. ~ M.A.M.

~ Financing the Union ~

Borrowing Money

Prior to 1861, the USA relied on tariffs and custom duties for most of its revenue. A strong sense against accumulating debt characterized administrations from Thomas Jefferson to Franklin Pierce. Only in times of war did the federal government resort to selling bonds or notes to bankers, brokers, and their large customers. When James Buchanan became President in March 1857, the federal debt level was a modest $28 million. The financial panic that gripped the nation later that year led to a sharp decline in revenue from tariffs and duties, and required the Treasury to issue large amounts of bonds and notes to cover the shortfall. President Buchanan also had to rely on borrowed funds to pay for his initiatives involving Cuba and the Mormon territory, as well as the expansions of the Navy and the postal service. Between 1857 and 1861, the Treasury issued more than $142 million worth of bonds and notes; during those years, the federal government ran a cumulative deficit of more than $76 million.[1]

In February and March 1861, with secession already in process, the prospects of civil war growing, and the Treasury’s cash position at a very low level, Congress passed two separate bills authorizing the issuance of $35 million worth of government bonds. When Abraham Lincoln took the presidential oath in March 1861, the federal debt stood at the unusually high level of almost $77 million. In the early days of the Lincoln administration, the appetite for any new debt was quite low; the normal assortment of banker and broker subscribers purchased only $16 million (45%) of the ten-year and twenty-year bonds just mentioned.[2] During the next few months, increased tariffs and another modest note sale added about $15 million to the Treasury. However, the initial costs of expanding the Federal Army and Navy to meet the overt belligerence of the CSA totaled more than $24 million.

In order to secure Congressional approval of the financing needed to prosecute the war, President Lincoln called that body into special session in July 1861. At that time, Treasury Secretary Chase suggested raising the unprecedented sum of $320 million to finance the war of rebellion through a combination of the sale of government bonds ($240 million), increased tariffs ($57 million), new taxes or duties ($20 million), and the sale of public lands ($3 million).[3] In response, Congress authorized the sale of $250 million worth of bonds and the imposition of an income tax. Both funding mechanisms proved inadequate. The income tax was not scheduled to be collected until mid-1862; and Secretary Chase was able to negotiate an agreement to sell only $150 million worth of bonds to a group of banks in New York, Boston, and Philadelphia.[4] The end of 1861 found the Lincoln Administration reassessing the federal government’s need for funds to prosecute what officials now believed would be a long and expensive conflict.

In February 1862, Congress authorized the sale of another $500 million in bonds. But the Treasury had been having trouble selling its government bonds. In the second half of 1861, the firm of Jay Cooke & Company had been quite helpful in distributing Treasury obligations. So in February 1862, Secretary Chase commissioned Cooke to distribute the $500 million in newly approved twenty-year bonds. During the next two years, that firm actually sold more than $511 million of such securities. It did so through a new type of bond drive using newspaper advertisements and a network of 2,500 sales agents scattered across the country. Mr. Cooke wrote editorials suggesting that the purchase of these bonds (some in denominations as low as $50) was a patriotic act and should be considered by every citizen concerned with the preservation of the Union. His spectacular success in selling these obligations prompted Congress to authorize another $830 million bond issue in early 1865; Cooke’s firm sold them all by the summer of that year. By the end of the Civil War, the USA had financed about two-thirds of its $3.4 billion in direct costs by selling bonds.

In February 1862, Congress authorized the sale of another $500 million in bonds. But the Treasury had been having trouble selling its government bonds. In the second half of 1861, the firm of Jay Cooke & Company had been quite helpful in distributing Treasury obligations. So in February 1862, Secretary Chase commissioned Cooke to distribute the $500 million in newly approved twenty-year bonds. During the next two years, that firm actually sold more than $511 million of such securities. It did so through a new type of bond drive using newspaper advertisements and a network of 2,500 sales agents scattered across the country. Mr. Cooke wrote editorials suggesting that the purchase of these bonds (some in denominations as low as $50) was a patriotic act and should be considered by every citizen concerned with the preservation of the Union. His spectacular success in selling these obligations prompted Congress to authorize another $830 million bond issue in early 1865; Cooke’s firm sold them all by the summer of that year. By the end of the Civil War, the USA had financed about two-thirds of its $3.4 billion in direct costs by selling bonds.

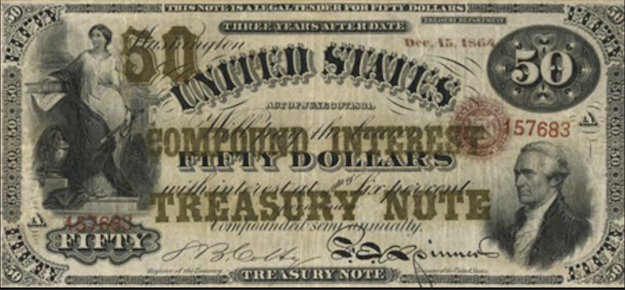

Printing Money

On the eve of the Civil War, the USA’s circulating currency consisted largely of $200 million worth of bank notes issued by more than 1,500 state banks. This system of independent issuers of money had its flaws, but it had been capable of handling the country’s financial needs. By the end of 1861, however, Treasury Secretary Chase was coming to view the existence of so many notes issued by state-chartered banks, and with varying denominations and degrees of security, as being detrimental to his attempts to finance the war.[5] Even while supervising the issuance of the bonds noted above, he suggested that the federal government issue $150 million worth of a new paper currency not backed by gold, but still considered an obligation of the USA. Printed on green paper, those “greenbacks” would be convertible into an equal amount of government bonds and considered legal tender for all public and private debts.[6]After two months of heated deliberation, Congress approved his plan. The new currency became quite acceptable as fiat money by merchants and consumers alike. Indeed, in July 1862, Congress authorized another $150 million greenback issue, and urged that about 25% of the notes be issued in denominations of one to five dollars. With the war’s costs steadily mounting, and the government’s ability to sell bonds still somewhat constrained, Congress approved the sale of an additional $150 million worth of greenbacks in early 1863. By the end of the war, approximately $450 million worth of this new national currency was circulating throughout the Union.[7]

Raising Taxes

The federal government and the states had long imposed a variety of taxes, e.g. poll taxes, excise taxes, property taxes, business taxes, and import duties. As noted above, however, the unusually large amounts of revenue that would be needed to finance the war effort required government officials to consider additional taxes even as they began to seek other sources of funds. Treasury Secretary Chase first persuaded Congress to establish an income tax in August 1861; but that law did not require anyone to pay such taxes before mid-1862. In July of that year, Congress passed a new Internal Revenue Act that adjusted the Revenue Act of 1861 by imposing a 3% tax rate on annual incomes between $600 and $10,000 and a 5% rate on incomes over that amount. Revenue from this source totaled less than $20 million in 1863. By the middle of 1864, Congress saw the need raise the rates on incomes over $5,000, increase other taxes (inheritance, excise, gross business receipts, licenses, personal property, etc.), and create an emergency tax (on top of the new rates) on incomes over $600.[8]

The income tax contributed only $2 million of the federal government’s total revenue from all taxes of about $38 million in the fiscal year ended June 30, 1863. Revenue from the income tax increased to $20 million in fiscal 1864 and $32 million in fiscal 1865. In total, all taxes generated about 21% of the federal government’s revenue during the war years.[9]

~ Financing the Confederacy ~

Borrowing Money

Unlike the long-established USA, the fledgling CSA had no history of raising money to support its activities. But its savvy founding political leaders certainly regarded meeting the new nation’s financial requirements as one of their most important tasks. On February 8, 1861, the Provisional Confederate Government accepted a loan of $500,000 from the State of Alabama. On February 19, 1861, the day after his inauguration as President of the Confederacy, Jefferson Davis announced the appointment of Christopher G. Memminger as Secretary of the Treasury. With no currency of its own, and no history or power of taxation, the new government faced a limited set of fund-raising options. In late February, the Confederate Congress authorized the first of what would be many offerings of Treasury bonds to finance the government’s operations. The government aimed this so-called Banker Loan at the region’s commercial and banking interests, and asked those institutions to purchase the bonds with specie. Congress instituted a small export duty on cotton, and earmarked the proceeds of that tax to pay both interest (8%) and principal (in ten years) on that loan. Eventually, subscribers in such leading commercial centers as New Orleans and Charleston purchased all of the bonds.[10]

In the meantime, in May, the Confederate Congress had authorized another $50 million bond offering. This time, the authorizing legislation stated that the bonds could be purchased through the use of specie, military stores, or the anticipated proceeds from the sale of raw material or manufactured articles. This so-called Produce Loan took note of the lack of a substantial amount of hard currency among the Southern planter and farmer classes. It recognized those people had large amounts of cotton, tobacco, or other provisions that they would be willing to loan the government. Thus, through the creative use of hypothecation (whereby a borrower pledges collateral to secure a debt), a farmer could assign the anticipated proceeds from the sale of his crops to the Confederate Treasury in return for receiving a Confederate bond. In August, the Confederate Congress extended and expanded this Produce Loan to $100 million; in April 1862, it extended it further to $250 million.[11] After much initial success in raising these funds, the declining military fortunes of the Confederate armies had a depressing effect on the CSA’s ability to finance itself with these vehicles. By the end of 1864, it had raised only about an additional $34 million from these Produce Loans.

In October 1862, based at least partly on the successes of the armies of the CSA on the battlefield, the Paris-based Emile Erlanger and Company contacted Confederate officials with a proposal for floating their government a loan. In March 1863, and after much negotiation, that firm signed an agreement to broker a loan of up to $15 million with various subscribers in England and several European countries. The bonds were to be redeemable in cotton—as long as the investor took possession of that commodity within the boundaries of the Confederacy. In the first several months of marketing (i.e. reselling) the bonds, Erlanger was quite successful. However, the European appetite for those obligations began to decline in August—after the Battle of Gettysburg. By the time Erlanger ceased marketing the bonds, the offering had netted the Confederacy only about $8.8 million of the anticipated amount of $15 million.[12]

In March, 1865, the Confederate Congress authorized another $30 million bond offering that could only be purchased with specie. It promised to redeem the notes in specie as well, and to do so within two years after the end of the war. There is no record that it ever sold any of those bonds. Nor did it sell a smaller $3.0 million issue it tried to float later that month. In its dying days, the CSA did raise $300,000 in specie from a group of Richmond banks.

In total, by the end of the war, the CSA had used more than fourteen bond issues to fund a bit more than one-third of its expenditures.

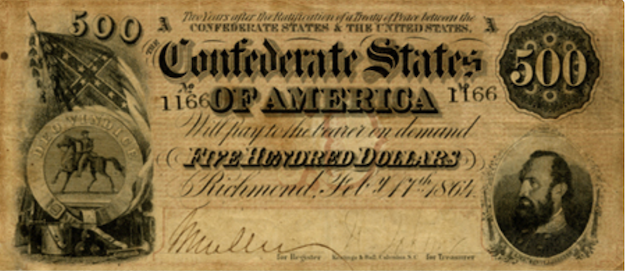

Printing Money

Even as Confederate treasury officials sought to sell bonds for specie in February 1861, they realized the potentially high costs of the imminent war would require them to seek other sources of financing. Issuing paper money in the form of Treasury notes achieved several purposes, the most practical of which involved the provision of a freely circulating medium of exchange. Doing so would also provide “money” for establishing the CSA’s financial infrastructure and for “paying” the providers of war materials. The government began to distribute these notes (some of which paid interest) in March 1861, and printed them in denominations as small as five dollars. As war expenditures increased, so did the issuance of these notes. The Confederate Congress authorized them in several tranches. The total amount of notes outstanding rose to more than $300 million by the summer of 1861 and to more than $1.5 billion by the end of 1864.[13]

Counterfeiting was a major problem. In attempting to combat this problem, many times from late 1861 to early 1865, the government forced holders to exchange one type of note for another by retiring issues of interest-bearing notes and substituting non-interest-bearing notes. Officials hoped investors who had been hoarding the former would use the latter as a circulating medium of exchange. The Confederacy also issued new notes with different terms and maturity dates, and tried several times to make all those notes legal tender. After all, most Southern banks came to regard them as proper payment for all debts. Treasury Secretary Memminger noted that the “legal tender” designation was not necessary. Further, he suggested that taking such an action would violate the “states’ rights” nature of the Confederacy, and arouse suspicion about a stronger-than-desired national government. Other voices joined him in doubting the power of a “legal tender” declaration to restrain the high rate of inflation and large amount of counterfeiting that continued to plague the Southern economy throughout the duration of the war.

Counterfeiting was a major problem. In attempting to combat this problem, many times from late 1861 to early 1865, the government forced holders to exchange one type of note for another by retiring issues of interest-bearing notes and substituting non-interest-bearing notes. Officials hoped investors who had been hoarding the former would use the latter as a circulating medium of exchange. The Confederacy also issued new notes with different terms and maturity dates, and tried several times to make all those notes legal tender. After all, most Southern banks came to regard them as proper payment for all debts. Treasury Secretary Memminger noted that the “legal tender” designation was not necessary. Further, he suggested that taking such an action would violate the “states’ rights” nature of the Confederacy, and arouse suspicion about a stronger-than-desired national government. Other voices joined him in doubting the power of a “legal tender” declaration to restrain the high rate of inflation and large amount of counterfeiting that continued to plague the Southern economy throughout the duration of the war.

The inflationary pressures on the economy were exacerbated by the printing and circulation of “money” in the form of notes issued by almost all the southern states, by many large cities in the region, and by private companies such as railroads, turnpike companies, insurance firms, et al. Indeed, the need for additional mediums of exchange was so great that many independent businessmen also issued their own personal notes. These so-called “shinplasters” usually gave the holder the right to receive a specific amounts of goods or services from grocers, carpenters, innkeepers, et al. Treasury Secretary Memminger officially acknowledged the circulation of about $20 million worth of all these state/city/business notes; but historians have never been able to determine the true amount outstanding of these collective forms of money.

Raising Tariffs and Taxes

In May 1861, Treasury Secretary Memminger suggested that existing tariff laws and the increases in rates approved in February would yield the CSA $25 million in revenue during that year. However, due to the success of the Union blockade of much of the Southern coastline the total received was closer to $1 million. Indeed, import duties totaled only $3.5 million for the entire period 1861 to 1865. The legislation authorizing the February 1861 Banker Loan also imposed an export duty, payable in specie, on all cotton shipped after August 1. Again, the Union blockade severely restricted exports of that and many other products. The total amount of revenue from this source was negligible, compared to some pre-war estimates of as much as $20 million.[14]

As early as May 1861, Secretary Memminger began suggesting the need to impose taxes on property, capital, merchandise, stock holdings, etc. in order to raise funds. In August, Congress authorized a tax on a list of specific items, including real estate and the value of slaves. It was to be collected in May 1862, based on assessed values as of the end of 1861. When the time came for payment, however, only two of the eleven states had made complete assessments; six others had made none at all. Eventually, the government began to collect these taxes; by the middle of 1863 the records show the receipt of approximately 90% of the estimated owed amount of $20 million. However, eight of the eleven states borrowed the money (via state notes) to pay the taxes owed by their cash-strapped citizens. So the total amount of cash generated by the tax fell far short of the anticipated amount.[15]

As early as May 1861, Secretary Memminger began suggesting the need to impose taxes on property, capital, merchandise, stock holdings, etc. in order to raise funds. In August, Congress authorized a tax on a list of specific items, including real estate and the value of slaves. It was to be collected in May 1862, based on assessed values as of the end of 1861. When the time came for payment, however, only two of the eleven states had made complete assessments; six others had made none at all. Eventually, the government began to collect these taxes; by the middle of 1863 the records show the receipt of approximately 90% of the estimated owed amount of $20 million. However, eight of the eleven states borrowed the money (via state notes) to pay the taxes owed by their cash-strapped citizens. So the total amount of cash generated by the tax fell far short of the anticipated amount.[15]

In April 1863, the acute funding shortage persuaded the Confederate Congress to pass a bill imposing a variety of new taxes on profits, agricultural products, businesses, and income. A peculiar provision imposed a tax-in-kind fee on agricultural output; farmers would send one-tenth of their output of wheat, corn, oats, etc. to government-run quartermaster depots. While this provision yielded large amounts of foodstuffs for the Confederate armies, it did not help increase the funds in the Treasury Department’s coffers.

In February 1864, the Confederate Congress was forced by necessity to pass another Tax Act that imposed new taxes on most tangible assets owned by Southern individuals and businesses. As had been the case for years, the damage caused by the fighting, an inefficient collection system, large amounts of fraud, and rampant non-compliance led to collections from this new round of taxes amounting to only about 80% of the estimated $145 million anticipated in the authorizing legislation. Throughout the war years, despite numerous political, institutional and infrastructure-related obstacles, the CSA collected more than $200 million from duties and taxes, a bit more than 9% of its total revenue.

~ Conclusion ~

The decisions made in the USA and CSA about financing alternatives during the Civil War reflected long-standing ideological beliefs in the two territories. Northerners generally supported traditional ideas (the expansion of federal debt), as well as new concepts (a national currency and a federal income tax). The fortunate appearance of banker Jay Cooke and his imaginative bond-selling scheme made the floatation of various issues of government debt much more efficient and effective than officials imagined could be achieved at the beginning of the war. Southerners wary of national political and economic dominance by the central state were not interested in the issuance of a national currency. Yet, both the central government and the states were quite willing to print some forms of currency in the form of both interest-bearing and non-interest-bearing notes. Members of the Confederate Congress resisted a national taxing regime and never pushed to generate a significant percentage of the Confederacy’s revenue from that source. Treasury Department officials were willing to issue debt instruments, and often used imaginative concepts such as Produce Loans and Cotton Loans to obviate the needs for redemption in scarce specie.

In sum, officials in both the USA and the CSA were remarkably successful in finding sufficient financial resources to support their armies in the field for the better part of four long, bloody years. The northern states were not the scene of significant fighting. So they were able to maintain the productivity of their agricultural, industrial, and commercial enterprises. The federal government was both willing and able to able to employ a high degree of borrowing power to fund the costs of the war. Most businessmen, landowners, and merchants enjoyed relatively productive economic lives, so they were able to afford the relatively high level of taxation the federal government imposed to raise additional funds. The experiment of printing government-backed pieces of paper representing money was also quite successful, largely due to the faith of the populace in the federal government. In sum, the USA was able to use borrowed funds and monies raised from taxes to supply almost 90% of its financial needs.

The southern states that had definitely contributed to the nation’s economic strength before the war were just not able to maintain or expand their economic base while the fighting raged. Unfortunately, as the Confederacy’s borrowing needs grew, its credit-worthiness weakened, so the loans that it was able to secure at the start of the conflict dwindled to nominal levels by the end of it. Moreover, its political leaders and leading citizens were wary of giving the central government sufficient authority to raise taxes or create a national currency. While the CSA was able to borrow a bit more than one-third of its financial needs, it was forced by circumstances to print and issue promissory notes (money) for slightly more than half of its war-related expenditures.

~ Footnotes ~

[1] Jane Flaherty, “The Exhausted Condition of the Treasury on the Eve of the Civil War”. Civil War History, Vol. 55, No. 2 (June 2009): 253.

[2] Robert T. Patterson, “Government Finance on the Eve of the Civil War”. The Journal of Economic History, Vol. 12, No. 1 (Winter, 1952): 42.

[3] Joseph A. Hill, “The Civil War Income Tax”. The Quarterly Journal of Economics, Vol. 8, No. 4 (July, 1894): 417.

[4] Gary Giroux, “Financing the American Civil War: Developing New Tax Sources”. Accounting History, Vol. 17, No. 1 (2012): 92.

[5] Frederick J. Blue. Salmon P. Chase, A Life in Politics (Kent, OH: Kent State University Press, 1987), 157.

[6] Murray N. Rothbard, A History of Money and Banking in the United States: The Colonial Era to World War II (pdf) (Auburn, AL: The Ludwig von Mises Institute, 2002), 123.

[7] Margaret G. Myers, A Financial History of the United States. New York: Columbia University Press. 1970), 157.

[8] Ibid., 159.

[9] Joseph J. Thorndike, “An Army of officials: The Civil War Bureau of Internal Revenue”. Tax Notes, Vol. 93, No. 12 (Dec., 2001): 1753.

[10] Richard Cecil Todd, Confederate Finance. Athens: University of Georgia Press, 2009), 30.

[11] Ibid., 41

[12] Judith Fenner Gentry, “A Confederate Success in Europe: The Erlanger Loan”. The Journal of Southern History, Vol. 36, No. 2 (May, 1970): 170.

[13] Todd, Confederate Finance, 120.

[14] Ibid., 125.

[15] Ibid., 134.

Written by Michael A. Martorelli for Essential Civil War Curriculum ~ November 2014

~ The Author ~

Michael A. Martorelli is a finance industry professional and 30th year as a Civil War reenactor. His career has included roles in investment research, money management, and investment banking. He has also been an adjunct instructor and guest lecturer at several colleges and universities in the Philadelphia area. He currently teaches at Philadelphia University. Combining his interests in finance and history, Mr. Martorelli has written several articles and book reviews for Financial History, the Magazine of the Museum of American Finance. In February 2013 he wrote about Civil War Artillery for the Essential Civil War Curriculum. During the 1970s, he earned a BS in Business Administration and an MBA from Drexel University in Philadelphia. In 2011, he earned an MA in History from American Military University.