“For money, some men will allow the innocent to hang. They will turn traitor… they will lie, cheat, steal and they will kill. They appear brilliant, charming and generous! But they are deadly! Such are men as Dimitrios.”

Americans, living in what is called the richest nation on earth, seem always to be short of money. Wives are working in unprecedented numbers, husbands hope for overtime hours to earn more, or take part-time jobs evenings and weekends, children look for odd jobs for spending money, the family debt climbs higher, and psychologists say one of the biggest causes of family quarrels and breakups is “arguments over money.” Much of this trouble can be traced to our present “debt-money” system.

Americans, living in what is called the richest nation on earth, seem always to be short of money. Wives are working in unprecedented numbers, husbands hope for overtime hours to earn more, or take part-time jobs evenings and weekends, children look for odd jobs for spending money, the family debt climbs higher, and psychologists say one of the biggest causes of family quarrels and breakups is “arguments over money.” Much of this trouble can be traced to our present “debt-money” system.

Too few Americans realize why Christian Statesmen wrote into Article I of the U.S. Constitution: Congress shall have the Power to Coin Money and Regulate the Value Thereof…

They did this in prayerful hope it would prevent “love of money” from destroying the Republic they had founded. Among other things in this series – we shall see how subversion of Article I has brought on us the “evil” of which God’s Word had warned.

What follows, became the final manuscript for a live broadcast series, ‘Mask of Dimitrios,’ which originally aired on short-wave radio in 2004, wherein we described the aftermath of the establishment of the Federal Reserve Bank. In the fall of 2010, we posted the series over eight consecutive weekends on a now defunct site for the purposes of research, education and consideration. Some of what you’ll discover, are from the writings of one Henry Ford – yes – THAT Henry Ford, as told through a series of “Editorials“, originally posted in a now little remembered publication (owned by Ford), in addition to the testimony given before the U.S. Senate, by the individual, who would become (rubber-stamped is more like it) the Federal Reserves’ first ‘Alan Greenspan’ – one Paul Warburg. Additional reference material was drawn upon to develop the original audio presentation.

Where does the responsibility of this debacle originate? Who were the perpetrators of this massive “check-kiting” scheme, which has brought America to it’s knees? In this series, ‘Mask of Dimitrios‘, we hope to bring the truth to the surface. ~ Jeffrey Bennett, Publisher

WARNING: The following publication is based on years of historical study, conducted by a number of reliable sources – AND from records of the United States Senate. Contained within are numerous references to ‘Jews’ – however this is not meant to attack or be considered as Anti-Semitic. Truth and history is what it is, and nothing can be done to change this. ~ J.B.

‘Mask of Dimitrios’

Chapter I ~ ‘Prelude to a Game’

How the People Lost Control of the Federal Reserve

“If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around them (around the banks), will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered.” ~ Thomas Jefferson

Instead of the Constitutional method of creating our money and putting it into circulation, we now have an entirely unconstitutional system. This has resulted in almost disastrous conditions, as we shall see.

Instead of the Constitutional method of creating our money and putting it into circulation, we now have an entirely unconstitutional system. This has resulted in almost disastrous conditions, as we shall see.

Since our money was handled both legally and illegally before 1913, this series of programs will primarily consider only the years following 1913, since from that year on, ALL of our money has been created and issued by an illegal method that will eventually destroy the United States. Prior to 1913, America was a prosperous, powerful, and growing nation, at peace with its neighbors and the envy of the world. But – in December of 1913, Congress, with many members away for the Christmas holidays, passed what has since been known as the FEDERAL RESERVE ACT. Omitting the burdensome details, it simply authorized the establishment of a Federal Reserve Corporation, with a Board of Directors (The Federal Reserve Board) to run it, and the United States was divided into 12 Federal Reserve “Districts.”

This simple, but terrible, law completely removed from Congress the right to “create” money or to have any control over its “creation,” and gave that function to the Federal Reserve Corporation. This was done with appropriate fanfare and propaganda that this would “remove money from politics” (they didn’t say “and therefore from the people’s control”) and prevent “Boom and Bust” from hurting our citizens. The people were not told then, and most still do not know today, that the Federal Reserve Corporation is a private corporation controlled by bankers and therefore is operated for the financial gain of the bankers over the people rather than for the good of the people. The word “Federal” was used only to deceive the people.

More Disastrous Than Pearl Harbor

Since that “day of infamy” – more disastrous to us than Pearl Harbor – the small group of “privileged” people who lend us “our” money have accrued to themselves all of the profits of printing our money – and more! Since 1913 they have “created” tens of billions of dollars in money and credit, which, as their own personal property, they then lend to our government and our people at interest. “The rich get richer and the poor get poorer” had become the secret policy of our National Government.

Money is Man’s Only “Creation”

Economists use the term “create” when speaking of the process by which money comes into existence. Now, creation means making something that did not exist before.

Lumbermen make boards from trees, workers build houses from lumber, and factories manufacture automobiles from metal, glass and other materials. But in all these they did not “create,” they only changed existing materials into a more usable and, therefore, more valuable form. This is not so with money. Here, and here alone, man actually “creates” something out of nothing. A piece of paper of little value is printed so that it is worth a piece of lumber. With different figures it can buy the automobile or even the house. Its value has been “created” in the true meaning of the word.

Money “Creating” Profitable

First of all, money is very cheap to make, and whoever does the “creating” of money in a nation can make a tremendous profit! Builders work hard to make a profit of 5% above their cost to build a house.

Auto makers sell their cars for 1% to 2% above the cost of manufacture and it is considered good business. But money “manufacturers” have no limit on their profits, since a few cents will print a $1 bill or a $10,000 bill.

That profit is part of our story, but first let us consider another unique characteristic of the thing – money, the love of which is the “root of all evil” and the men who brought us the evil Federal Reserve system.

Adequate Money Supply Needed

An adequate supply of money is indispensable to civilized society. We could forego many other things, but without money industry would grind to a halt, farms would become only self-sustaining units, surplus food would disappear, jobs requiring the work of more than one man or one family would remain undone, shipping and large movements of goods would cease, hungry people would plunder and kill to remain alive, and all government except family or tribe would cease to function.

An overstatement, you say? Not at all. Money is the blood of civilized society, the means of all commercial trade except simple barter. It is the measure and the instrument by which one product is sold and another purchased. Remove money or even reduce the supply below that which is necessary to carry on current levels of trade, and the results are catastrophic. For an example, we need only look at America’s Depression of the early 1930’s.

The Bankers Depression of the 1930’s

In 1930 America did not lack industrial capacity, fertile farmland, skilled and willing workers or industrious farm families. It had an extensive and highly efficient transportation system in railroads, road networks, and inland and ocean waterways. Communications between regions and localities were the best in the world, utilizing telephone, teletype, radio, and a well-operated government mail system. No war had ravaged the cities or the countryside, no pestilence weakened the population, nor had famine stalked the land. The United States of America in 1930 lacked only one thing: an adequate supply of money to carry on trade and commerce.

In the early 1930’s, Bankers, the only source of new money and credit, deliberately refused loans to industries, stores and farms. Payments on existing loans were required however, and money rapidly disappeared from circulation. Goods were available to be purchased, jobs waiting to be done, but the lack of money brought the nation to a standstill. By this simple ploy America was put in a “depression” and the greedy Bankers took possession of hundreds of thousands of farms, homes, and business properties. The people were told, “times are hard,” and “money is short.” Not understanding the system, they were cruelly robbed of their earnings, their savings, and their property.

Money for Peace? No! Money for War? Yes!

World War II ended the “depression.” The same Bankers who in the early 30’s had no loans for peacetime houses, food and clothing, suddenly had unlimited billions to lend for Army barracks, K-rations and uniforms! A nation that in 1934 couldn’t produce food for sale, suddenly could produce bombs to send free to Germany and Japan!

With the sudden increase in money, people were hired, farms sold their produce, factories went to two shifts, mines re-opened, and “The Great Depression” was over!

Some politicians were blamed for it and others took credit for ending it. The truth is the lack of money (caused by the Bankers) brought on the depression, and adequate money ended it. The people were never told that simple truth and in this article we will endeavor to show how these same Bankers who control our money and credit have used their control to plunder America and place us in bondage.

They Print It – We Borrow It and Pay Them Interest

We shall start with the need for money. The Federal Government, having spent more than it has taken from its citizens in taxes, needs, for the sake of illustration, $1,000,000,000. Since it does not have the money, and Congress has given away its authority to “create” it, the Government must go to the “creators” for the $1 billion. But, the Federal Reserve, a private corporation, doesn’t just give its money away! The Bankers are willing to deliver $1,000,000,000 in money or credit to the Federal Government in exchange for the Government’s agreement to pay it back – with interest! So Congress authorizes the Treasury Department to print $1,000,000,000 in U.S. Bonds, which are then delivered to the Federal Reserve Bankers.

The Federal Reserve then pays the cost of printing the $1,000,000,000 (about $1,000) and makes the exchange. The Government then uses the money to pay its obligations. What are the results of this fantastic transaction? Well, $1 billion in Government bills are paid all right, but the Government has now indebted the people to the Bankers for $1 billion on which the people must pay interest! Tens of thousands of such transactions have taken place since 1913 so that by the 1980’s, the U.S. Government was indebted to the Bankers for over one-trillion dollars on which the people paid over $100 billion a year in interest alone with no hope of ever paying off the principal and over twenty years later the debt has grown by nearly seven-times that of the 1980’s. Supposedly our children and following generations will pay forever and forever!

And There’s More…

You say, “This is terrible!” Yes, it is, but we have shown only part of the sordid story. Under this unholy system, those United States Bonds have now become “assets” of the Banks in the Reserve System which they then use as “reserves” to “create” more “credit” to lend. Current “reserve” requirements allow them to use that $1 billion in bonds to “create” as much as $15 billion in new “credit” to lend to States, Municipalities, to individuals and businesses. Added to the original $1 billion, they could have $16 billion of “created credit” out in loans paying them interest with their only cost being $1,000 for printing the origina1 $1 billion! Since the U.S. Congress has not issued Constitutional money since 1863 (over 150 years), in order for the people to have money to carry on trade and commerce they are forced to borrow the “created credit” of the Monopoly Bankers and pay them usury-interest!

And There’s Still More…

In addition to the vast wealth drawn to them through this almost unlimited usury, the Bankers who control the money at the top are able to approve or disapprove large loans to large and successful corporations to the extent that refusal of a loan will bring about a reduction in the price that that Corporation’s stock sells for on the market. After depressing the price, the Bankers’ agents buy large blocks of the stock, after which the sometimes multi-million dollar loan is approved, the stock rises, and is then sold for a profit. In this manner billions of dollars are made with which to buy more stock. This practice is so refined today that the Federal Reserve Board need only announce to the newspapers an increase or decrease in their “re-discount rate” to send stocks up and down as they wish.

Using this method since 1913, the Bankers and their agents have purchased secret or open control of almost every large corporation in America. Using that control, they then force the corporations to borrow huge sums from their banks so that corporation earnings are siphoned off in the form of interest to the banks.

This leaves little as actual “profits” which can be paid as dividends and explains why stock prices are so depressed, while the banks reap billions in interest from corporate loans. In effect, the bankers get almost all of the profits, while individual stock holders are left holding the bag.

The millions of working families of America are now indebted to the few thousand Banking Families for twice the assessed value of the entire United States. And these Banking Families obtained that debt against us for the cost of paper, ink, and bookkeeping!

The Interest Amount is Never Created

The only way new money (which is not true money, but is “credit” representing a debt), goes into circulation in America is when it is borrowed from Bankers. When the State and people borrow large sums, we seem to prosper. However, the Bankers “create” only the amount of the principal of each loan, never the extra amount needed to pay the interest. Therefore, the new money never equals the new debt added. The amounts needed to pay the interest on loans is not “created,” and therefore does not exist!

Under this kind of a system, where new debt always exceeds the new money no matter how much or how little is borrowed, the total debt increasingly outstrips the amount of money available to pay the debt. The people can never, ever get out of debt!

- In 1910 the U.S. Federal debt was only $1 billion, or $12.40 per citizen. State and local debts were practically non-existent.

- By 1920, after only 6 years of Federal Reserve shenanigans, the Federal debt had jumped to $24 billion, or $228 per person.

- In 1960 the Federal debt reached $284 billion, or $1,575 per citizen and State and local debts were mushrooming.

- By 1981 the Federal debt passed $1 trillion and was growing exponentially as the Banker’s tripled the interest rates. State and local debts are now MORE than the Federal, and with business and personal debts totaled over $6 trillion, 3 times the value of all land and buildings in America.

- During the administration of George W. Bush, the Federal debt surpassed the $7 trillion dollar level – about $25,000 per citizen.

- In the first 18 months of the Barack Obama administration, it has been said, that more debt was created than by all previous administrations combined – going all the way back to the Presidency of George Washington.

If we signed over to the money-lenders all of America we would still owe them 14 more Americas (plus their usury, of course!) NOTE: This figure is no longer valid, as it is much higher. (07.18.18)

However, they are too cunning to take title to everything. They will instead leave you with some “illusion of ownership” so you and your children will continue to work and pay the Bankers more of your earnings in ever-increasing debts. The “establishment” has captured our people with their ungodly system of usury and debt as certainly as if they had marched in with a uniformed army.

Where does the responsibility of this debacle originate? Who were the perpetrators of this massive “check-kiting” scheme, which has brought America to it’s knees? In this series, Mask of Dimitrios, we hope to bring the truth to the surface.

Jewish Ideas in America Monetary Affair

“When I came here I was at once impressed by the lack of system, by the old-fashioned nature of the system that prevailed here; and I got immediately into one of those periods of high interest rates, where call money went up to 25 and 100 percent; and I wrote an article on the subject then and there for my own benefit. ~ Paul Warburg

It has been said that Jewish bankers exercise their large measure of control because they are abler than the other bankers.

The great Jewish banking houses of the United States are foreign importations, as perhaps everyone knows. Most of them were at one time, sufficiently recent to be considered in their immigrant status, while the thought of them as aliens was and still are stimulated by their retention of oversea connections. It is this international quality of the Jewish banking group which has largely accounted for Jewish financial power: there has remained team-play, intimate understandings, and while there remains a margin of competition among themselves (as at golf) there is also a wiping out of that margin when it comes to a contest between Jewish and “Gentile” capital.

Four conspicuous contemporary names in Jewish-American finance are Belmont, Schiff, Warburg and Kahn. Each of them, are of foreign origin.

August Belmont was the earliest and arrived in America in 1837 as the American representative of the Rothschilds in whose offices he had been raised. His birthplace was that great center of Jewish international finance, Frankfort-on-the-Main. He became the founder of the Belmont family in America, which has largely forgotten its Jewish origin. Politics was a part of his concern in this country, and during the critical time from 1860 to 1872 he was chairman of the National Democratic Committee. His management of the Rothschild interests was exceedingly profitable to that house, although the operations in which he engaged were quite simple compared with the operations of the present day.

Jacob H. Schiff

Jacob H. Schiff was another Jewish financier who was given to the world by Frankfort-on-the-Main. He entered the United States in 1865, after having passed his apprenticeship in the office of his father, who was also an agent of the Rothschilds. The name Schiff runs a long way back without change, unlike the name of Rothschild. Originally named Bauer, this family of financiers took a new name from the red shield which adorned their house in the Jewish section of Frankfort and thus became “Rot-schild.” Commonly the last syllable is pronounced as if it were “child”; it is “schild” – ‘shield‘. An epoch-making family in itself, it has trained hundreds of agents and apprentices, of whom Jacob Schiff was one. He became one of the principal channels through which German-Jewish capital flowed into American undertakings, and his agency in these matters gave him a place in many important departments of American business, especially railroads, banks, insurance companies and telegraph companies. He married Theresa Loeb, and in due time came to be head of the firm of Kuhn, Loeb & Company.

Mr. Schiff, as well, was interested in politics with a Jewish angle, and was perhaps the moving force in the campaign which forced Congress and the President to break off treaty relations with Russia, then a friendly nation, on a strictly Jewish question which had been skillfully given an American aspect. Mr. Schiff was of inestimable assistance to Japan in the war against Russia, but is understood to have been disappointed by Japan’s shrewdness in preventing too high a return being made for that assistance.

Associated with Mr. Schiff in Kuhn, Loeb & Company is Otto Herman Kahn, who is probably more international than were either of the two gentlemen mentioned above and is more constantly engaged in dabbling in mysterious matters of an international nature. This characteristic may be accounted for, however, by his experience of many countries. He was born in Germany and is also a product of the Frankfort-on-the-Main school of finance, having had connection with the Frankfort Jewish house of Speyer.

Of just how many countries Mr. Kahn has been a citizen is a question not easy to determine because of the doubt that was once cast upon his American citizenship by a protest against his being permitted to cast his vote last year and by his failure – the announced cause being physical indisposition – to cast his vote. If Mr. Kahn was a citizen of the United States (a status that would be readily proclaimed upon proof that he was), that probably increases the number of his citizenships to three. He was a German citizen by birth, and served in the German Army. In 1914, in August, at the time of the outbreak of the European War, when efforts were being made, which afterwards succeeded, to put Paul M. Warburg, a member of the firm of Kuhn, Loeb & Company, on the Federal Reserve Board, Mr. Warburg testified that at that time Mr. Kahn was not a citizen of the United States.

Senator Bristow – “How many of these partners are American citizens, or are they all American citizens . . . .”

Mr. Warburg – “They are all American citizens except Mr. Kahn.” – (p. 7, Senate Hearings, August 1, 1914.)

Senator Bristow – “Now, the members of your firm, are they all American citizens except Mr. Kahn?”

Mr. Warburg – “Except Mr. Kahn, yes.”

Senator Bristow – “Was Mr. Kahn ever an American Citizen?”

Mr. Warburg – “No.”

Senator Bristow – “He never was?”

Mr. Warburg – “No; he is a British subject.”

The Chairman – “He lives in England, does he not?”

Mr. Warburg – “No. At one time he thought he would move to Europe, and that was when the question arose of his standing for Parliament; then he changed his mind and moved back to the United States.”

Senator Bristow – “He was at one time a candidate, or a prospective candidate for Parliament, was he not?”

Mr. Warburg – “No; he was not; but there was talk about it; it had been suggested, and he had it in his mind. Something had been written about it in the papers.” – (p. 76, Senate Hearings, August 3, 1914.)

So, that if Mr. Kahn was a citizen of the United States at that time, which as a matter of fact had been disputed, then he had been a citizen of three countries, Germany and Great Britain being the other two.

Mr. Kahn, by the way, was one of those Jews whose adoption of another form of faith brought no denunciation whatever from the Jews themselves. A most peculiar circumstance! But doubtless not inexplicable. Mr. Kahn was not called a “renegade Jew” nor any of the other nasty names heaped upon Jewish converts to Christianity, because he did not deserve them. They did not fit him. He was not renegade. And he never was regarded for a moment by Jacob H. Schiff as anything but a Jew, else that “Prince of Israel” would not have chosen him to remain in America and run the business of Kuhn, Loeb & Company, at a time when it seemed undesirable to put the junior Schiff in full charge of it.

Doubtless it was Mr. Kahn’s desire, just at the time Jacob Schiff made his wishes known, to go to England and stand for Parliament.

But from New York he fulfills, probably as well as he could from London, those mysterious missions which frequently take him to the Continent, at which times he makes what are regarded as certain authoritative decisions, though just whose decisions it is not always possible to say. In Paris particularly, and at points east thereof, Mr. Kahn has been established in the position of spokesman of the American Financial Hierarchy, which, of course, he is not. But he undoubtedly is the spokesmen of some group, possibly the group that so ably put through the Jewish program at the Peace Conference, the group that impressed Eastern Europe with the feeling that the United States of America was a very powerful Semitic empire. Mr. Kahn’s trips abroad are usually unheralded, but their results richly repay observation.

A fourth member of the Jewish financial group in America (which is the form of statement which Mr. Chaim Weizmann would sanction, rather than to say “Jewish-American financiers“) was Mr. Paul Warburg, to whose testimony we have just alluded.

Mr. Warburg was the most recent of all. He was born in Germany in 1868; he came to the United States in 1902; he became an American citizen in 1911. He came to the United States for the express purpose of reforming our financial system, and it is hardly possible to understand fully the system in operation today without reference to Paul Warburg. He was a man of very fine mind, a money-maker, but something more – a shrewd student of the systems by which money is made. There are two types engaged in the mere work of money-making, which is better described as “money-getting,” without reference to production; one type grubs away under whatever system obtains, regarding it as fixed as the solar system; another type is sufficiently detached to see the system as an artifice that may be mended, remodeled or supplanted altogether. Paul Warburg, scion of a long line of German Jewish bankers, is of the latter type. He was not content with the fact that the cash-register fills itself with money; he wants also to know how the cash-register works, and whether it can be worked. He was thus a student of money and of the number of ways in which it can be manipulated.

Perhaps it will be best to let him tell his own story as far as he goes. When he told it to the Committee on Banking and Currency of the United States Senate in executive session, there was some dispute as to whether the proceedings should be recorded by stenographer. It was finally agreed that notes should be made but should not be divulged. The testimony was printed, “in confidence” on August 5, 1914, and nominally “made public” on August 12.

The Warburgs were one of the international families whose importance was not realized until World War I, and would not have been realized then if their internationalism had not been so apparent. It was an interesting spectacle to see brothers occupying important places of counsel on either side of the great struggle.

Paul Warburg learned the rudiments of banking in his father’s bank at Hamburg, Germany, studying the over-sea trade that is the foundation of that city’s business. The banking house of Warburg in Hamburg dates from 1796.

Mr. Warburg – “After that I went to England, where I stayed for two years, first in the banking and discount firm of Samuel Montague & Company, and after that I took the opportunity of staying two months in the office of a stockbroker in order to learn that part of the business.

“After that I went to France, where I stayed in a French bank, so that … “

The Chairman – “What French bank was that?”

Mr. Warburg – “It is the Russian bank for foreign trade, which has an agency in Paris.

“And after that I went back to Hamburg and worked there again for a year, I think.

“Then I went round to India, China and Japan.

“And then I came to this country for the first time in 1893. I stayed here only a short time then, and went back to Hamburg, and then became a partner of the firm in Hamburg.”

The Chairman – “How long were you in Hamburg then in the banking business?”

Mr. Warburg – “Until 1902 . . . . And then I moved over here to this country to become a partner of Kuhn, Loeb & Company.”

“I explained in the curriculum which I gave you, Mr. Chairman, that by marriage I am related to members of the firm, the late Mr. Loeb having been my father-in-law, which brought about a desire on the part of the family to bring me over here . . . . I ought to say that I got married in this country in 1895 and that I have been in this country every year since, for several months . . . . That is the history of my banking education.”

It will be recalled that Jacob H. Schiff also married a daughter of Mr. Loeb, so that Mr. Warburg married the sister of Mrs. Jacob H. Schiff. Felix Warburg, Paul’s brother, who is also in the firm, married Mr. Schiff’s daughter.

Mr. Warburg immediately cast a critical eye upon the state of financial affairs in the United States and it is significant of the grasp he already had on such matters that he found the country rather behind the times.

He conceived the ambition – the very daring ambition – of taking hold of the United States’ monetary system and making it what he thought it ought to be.

This alone would make him a remarkable man. It illustrates very well that detached point of view which the Jew is more fitted to take than any other man perhaps. He sees countries and systems with the same freedom from intimate bias with which another man would view assorted fish upon a market stall. Most of the world is engaged in doing its work and indulging its national, racial, domestic and social affections and inclinations; a small minority stands in the background and watches the entire mass at its unconscious maneuvers, and studies it as an observer studies a hive of bees. The man at work has no time except for his job. One man, standing back and studying 1,000 men at work, is able to see how he might utilize their labor or possess himself of a first toll on their production. Doubtless there must be men to stand at a sufficient distance from things to get a correct idea of their interrelationship, and doubtless such an attitude may be made of great service to the race, but doubtless it has also contributed to the selfish manipulation of natural and social processes.

Mr. Warburg testified:

“When I came here I was at once impressed by the lack of system, by the old-fashioned nature of the system that prevailed here; and I got immediately into one of those periods of high interest rates, where call money went up to 25 and 100 percent; and I wrote an article on the subject then and there for my own benefit.

“I was not here three weeks before I was trying to explain to myself the roots of the evil. I showed the article to a few friends but I kept it in my desk, because I did not want to be one of those who try to inform and educate the country after they have been here for a month or so; and I kept that article until the end of 1906, shortly before the panic, when those conditions arose again, and when one newspaper wanted for an issue at the end of the year an article dealing with the conditions in our country.

“Then I took out that article and touched it up and brought it up to date; and that was the first article of mine that was published. It was called, ‘Defects and Needs of Our Banking System.’ . . . .

“That was, however, the first time that I know of that the question of the discount system and the concentration of reserves was really brought out; and I got a great many encouraging letters asking me to go on and explain my ideas.”

Mr. Warburg was perfectly willing to talk to the committee about himself, but not about Kuhn, Loeb & Company, his firm.

“I cannot discuss the affairs of my firm nor my partners,” he said, “nor be asked to criticize acts of my partners, either to approve them or in any other way,” but eventually he did tell a number of things which students of American financial affairs have considered interesting. Of which more later.

On page 77 of the testimony, more personal matters appear:

Senator Bristow – “When did you become a citizen of the United States, Mr. Warburg?“

Mr. Warburg – “1911. Did I not answer that?“

Senator Bristow – “Perhaps so. Did you intend to become a citizen when you came to the United States in 1902?“

Mr. Warburg – “I had no definite intentions then, because some of the reasons that brought me over here were family reasons; . . . . That had a good deal to do with my first coming here; and I was not sure at all that I would stay here when I came.”

Senator Bristow – “When did you decide to become a citizen of the United States?“

Mr. Warburg – “In 1908, when I took out my papers.”

Senator Bristow – “When you took out your first papers? You took out your second papers then, in 1911?“

Mr. Warburg – “Yes.”

Senator Bristow – “You made your declaration in 1908; that is when you decided to become an American citizen?“

Mr. Warburg – “Yes.”

Senator Bristow – “Why did you wait as long as you did after you came to this country, before deciding to become a citizen of this country?“

Mr. Warburg – “I think that a man that does not come here as an immigrant; a man who has had, if you may call it such, a prominent position in his own country, will not give up his nationality so easily as a man who comes over here knowing that he does not care for his own country at all. I had been a very loyal citizen of my own country; and I think that a man who hesitates in giving up his own nationality and taking a new one, is apt to be more loyal to his new country when he does change his nationality than a man who gives up his old country more lightly.“

Senator Bristow – “Yes.“

Mr. Warburg – “I may add this: That a thing which had a great deal of influence on my making up my mind to remain in this country and work here, and become a part and parcel of this country, was that monetary reform work, for I felt I had a distinct duty to perform here; and I thought I could do that; and in fact I have been working on it since 1906 or 1907.

“Then I felt that it was the right thing for me to become an American citizen and work here and throw in my lot definitely with this country.“

Senator Bristow – “When you became an American citizen; and the motive which induced you to become an American citizen was, then, as I understand it, largely with a view of laboring to bring about a reform of the American monetary system?“

Mr. Warburg – “Well, you put it nearly exclusively on that. I think a man wants to feel that he is going to do some useful work in his country; that he has a mission to perform; and that is what happened to me . . . . Moreover, I had been long enough in this country then to have thoroughly taken root and feel that I was a part and parcel of it.“

Senator Bristow – “Yes. When did you first become active in promoting the monetary reforms in the United States?“

Mr. Warburg – “1906.“

Senator Bristow – “What was your method of promoting your ideas with regard to monetary reforms?“

Mr. Warburg – “Mainly writing.”

Senator Bristow – “Were you connected with the Monetary Commission?“

Mr. Warburg – “No, not directly . . . .“

Senator Bristow – “Were you consulted in regard to the report of the Monetary Commission in any way?“

Mr. Warburg – “Yes, Senator Aldrich consulted with me about details, and I gave him my advice freely.“

Senator Bristow – “And in regard to the bill which was prepared by Senator Aldrich in connection with the commission, were you consulted in regard to that?“

Mr. Warburg – “Yes.“

Senator Bristow – “What part did you have in the preparation of that bill, directly or indirectly?“

Mr. Warburg – “Well, only that I gave the best advice that I could give.“

Senator Nelson W. Aldrich

Most readers will recall that the name of “Aldrich” was, the synonym for the money power in government. Senator Nelson W. Aldrich was an able man and a tireless worker. His character for thoroughness and industry did more than anything else to disabuse the popular mind of the notion that such men were mere “tools of the money interest,” or engaged in their work out of lust for gain, or out of sheer pleasure in legislating against the interests of the people. Senator Aldrich led on tariff and financial matters because he understood them; and he understood them by tireless study of them; and, therefore, he was the master of other men who had not paid the price of knowledge. But, he understood these matters from the standpoint of the business interests only. He was sincerely desirous of the prosperity of the country, but that prosperity was written in banking balances.

Years ago it might not have been possible to judge him thus calmly, because then he represented in the public mind, more than any individual does today, the concentrated power of the financial group. Their prosperity was his first care, possibly because he believed that their prosperity was also the country’s.

It was such a man, then, that came to Mr. Warburg for advice. The labors of Senator Aldrich comprise many volumes of difficult material and Senator Aldrich’s appeal to Mr. Warburg was a very high compliment to the quality of the latter’s mind and financial experience – this, of course, assuming that Mr. Warburg’s counsel was not forced upon the Aldrich committee by the New York money interests.

In his testimony, Mr. Warburg did not tell all. The omission, however, was supplied by an article in Leslie’s Weekly in 1916, the author being B. C. Forbes.

It is a story of which Current Opinion said: “It reads like the opening in a chilling shocker.“

It appears that the conferences between Mr. Warburg and Senator Aldrich took place on an isolated island off the coast of Georgia – Jekyll Island. Included in the party, besides Senator Aldrich and Mr. Warburg, were two New York bankers and the then Assistant Treasurer of the United States. The mysteriousness of it all was well brought out by Mr. Forbes:

“Picture a party of the nation’s greatest bankers stealing out of New York on a private railroad car under cover of darkness, stealthily hieing hundreds of miles south, embarking on a mysterious launch, sneaking out to an island deserted by all but a few servants, living there a full week under such rigid secrecy that the name of not one of them was once mentioned lest the servitors learn their identity and disclose to the world this strangest, most secret episode in the history of American finance.

“The utmost secrecy was enjoined upon all. The public must not glean a hint of what was to be done. Senator Aldrich notified each one to go quietly into a private car which the railroad had received orders to draw up at an unfrequented platform. Drawn blinds balked any peering eyes that might be around. Off the party set. New York’s ubiquitous reporters had been foiled. So far so good. After bowling along the railroad hour after hour into southern country, the order was given to prepare to disembark.

“Stepping from the car when the station had been well cleared of travelers, the members of the expedition embarked in a small boat. Silence reigned, for the boatmen must not find out how distinguished were their passengers.

“In due time they drew up at another deserted pier. They were at Jekyll Island, off Georgia. The island was entirely un-peopled save for half a dozen servants.

“‘The servants must under no circumstances learn who we are,’ cautioned Senator Aldrich.

“‘What can we do to fool them?’ asked another member of the group. The problem was discussed.

“‘I have it,’ cried one. ‘Let’s all call each other by our first names. Don’t ever let us mention our last names.’

“It was so agreed.

“The dignified veteran Senator Aldrich, king of Rhode Island and a power second to none in the United States Senate, became just ‘Nelson’; . . . . and the quiet, scholarly member of the powerful international banking firm of Kuhn, Loeb & Company, became ‘Paul.’

“Nelson had meanwhile confided to Harry, Frank, Paul and Piatt that he was to keep them locked up on Jekyll Island, cut off from the rest of the world, until they had evolved and compiled a scientific currency system for the United States, a system that would embody all that was best in Europe, yet so modeled that it could serve a country measuring thousands where European countries measured only hundreds of miles.”

Mr. Forbes does not omit to write this further description of Mr. Warburg’s condition at the time: “unable then to speak idiomatic English with perfect freedom and without an accent, an alien not naturalized.”

Mr. Forbes also wrote – “Here is a German-American, but the sort of one that makes the hyphen look like a badge of honor.“

That was in 1916. Hyphens went out of fashion, though not entirely out of use, soon after.

Thus far the story of Paul Warburg…

Chapter II ~ ‘Let the Games Begin’

The Rothschilds and America

For many years the words international banker, Rothschild, Money and Gold have held a mystical type of fascination for many people around the world but particularly in the United States.

Over the years in the United States, the international bankers have come in for a great deal of criticism by a wide variety of individuals who have held high offices of public trust – men whose opinions are worthy of note and whose responsibilities placed them in positions where they knew what was going on behind the scenes in politics and high finance.

President Andrew Jackson

President Andrew Jackson, the only one of our presidents whose administration totally abolished the National Debt, condemned the international bankers as a “den of vipers” which he was determined to “rout out” of the fabric of American life. Jackson claimed that if only the American people understood how these vipers operated on the American scene “there would be a revolution before morning.”

Congressman Louis T. McFadden who, for more than ten years, served as chairman of the Banking and Currency Committee, stated that the international bankers are a “dark crew of financial pirates who would cut a man’s throat to get a dollar out of his pocket… They prey upon the people of these United States.”

John F. Hylan, then mayor of New York, said in 1911 that “the real menace of our republic is the invisible government which, like a giant octopus, sprawls its slimy length over our city, state and nation. At the head is a small group of banking houses, generally referred to as ‘international bankers.‘”

Were these leading public figures correct in their assessment of the situation, or were they the victims of some exotic form of paranoia?

Let us briefly review history analytically and unemotionally and uncover the facts. The truth, as it unfolds, will prove to be eye-opening and educational to those who are seeking to more clearly understand the mind-boggling events that have been (and are) taking place on the national and international scenes.

Humble Beginnings

Europe, towards the end of the eighteenth century or at the time of the American Revolution, was very different from what we know in the same area today. It was composed of a combination of large and small kingdoms, duchies and states which were constantly engaged in squabbles among themselves. Most people were reduced to the level of serfs – with no political rights. The meager ‘privileges’ that were granted to them by their ‘owners’ could be withdrawn at a moment’s notice.

It was during this period of time that a young man appeared on the European scene who was to have a tremendous impact on the future course of world history; his name was Mayer Amschel Bauer. In later years his name, which he had changed, became synonamous with wealth, power and influence. He was the first of the Rothschilds – the first truly international banker!

Mayer Amschel Bauer

Mayer Amschel Bauer was born in Frankfurt-On-The-Main in Germany in 1743. He was the son of Moses Amschel Bauer, an itinerant money lender and goldsmith who, tiring of his wanderings in Eastern Europe, decided to settle down in the city where his first son was born. He opened a shop, or counting house, on Judenstrasse (or Jew Street). Over the door leading into the shop he placed a large Red Shield.

At a very early age Mayer Amschel Bauer showed that he possessed immense intellectual ability, and his father spent much of his time teaching him everything he could about the money lending business, and the lessons he had learned from many sources. The older Bauer originally hoped to have his son trained as a Rabbi but the father’s untimely death put an end to such plans.

A few years after his father’s death, Mayer Amschel Bauer went to work as a clerk in a bank owned by the Oppenheimers in Hannover. His superior ability was quickly recognized and his advancement within the firm was swift. He was awarded a junior partnership.

Shortly thereafter he returned to Frankurt where he was able to purchase the business his father had established in 1750. The big Red Shield was still displayed over the door. Recognizing the true significance of the Red Shield (his father had adopted it as his emblem from the Red Flag which was the emblem of the revolutionary minded Jews in Eastern Europe), Mayer Amschel Bauer changed his name to Rothschild; in this way the House of Rothschild came into being.

Rothschilds and America

It would be extraordinarily naïve to even consider the possibility that a family as ambitious, as cunning and as monopolistically minded as the Rothschilds could resist the temptation of becoming heavily involved on the American front.

Following their conquest of Europe early in the 1800s, the Rothschilds cast their covetous eyes on the most precious gem of them all – the United States.

America was unique in modern history. It was only the second nation in history that had ever been formed with the Bible as its law book. [The United States was not formed with the Bible as its law book. It was founded by Masonic deists. Only low rank Masons respect the Bible and consider it their law book; the Founders were high rank Masons, and many professed their lack of respect for the Bible. The writer probably means that the Colonies were formed with the Bible as their law book, and this is basically true. – Ed.] Its uniquely magnificent Constitution was specifically designed to limit the power of government and to keep its citizens free and prosperous. Its citizens were basically industrious immigrants who ‘yearned to breath free’ and who asked nothing more than to be given the opportunity to live and work in such a wonderfully stimulating environment.

The results – the ‘fruit’ – of such a unique experiment were so indescribably brilliant that America became a legend around the globe. Many millions across the far flung continents of the world viewed America the Beautiful as the promised land.

The Big Bankers in Europe

The Rothschilds and their cohorts – viewed the wonderful results borne by this unique experiment from an entirely different perspective; they looked upon it as a major threat to their future plans.

The establishment Times of London stated: “If that mischievous financial policy which had its origin in the North American Republic [i.e. honest Constitutionally authorized no debt money] should become indurated down to a fixture, then that government will furnish its own money without cost. It will pay off its debts and be without a debt [to the international bankers]. It will become prosperous beyond precedent in the history of the civilized governments of the world. The brains and wealth of all countries will go to North America. That government must be destroyed or it will destroy every monarchy on the globe.“

The Rothschilds and their friends sent in their financial termites to destroy America because it was becoming “prosperous beyond precedent.”

The first documentable evidence of Rothschild involvement in the financial affairs of the United States came in the late 1820s and early 1830s when the family, through their agent Nicholas Biddle, fought to defeat Andrew Jackson’s move to curtail the international bankers. The Rothschilds lost the first round when in 1832, President Jackson vetoed the move to renew the charter of the ‘Bank of the United States’ (a central bank controlled by the international bankers). In 1836 the bank went out of business.

Plan of Destruction

In the years following Independence, a close business relationship had developed between the cotton growing aristocracy in the South and the cotton manufacturers in England. The European bankers decided that this business connection was America’s Achilles Heel, the door through which the young American Republic could be successfully attacked and overcome.

The Illustrated University History, 1878, p. 504, tells us that the southern states swarmed with British agents. These conspired with local politicians to work against the best interests of the United States. Their carefully sown and nurtured propaganda developed into open rebellion and resulted in the secession of South Carolina on December 29, 1860. Within weeks another six states joined the conspiracy against the Union, and broke away to form the Confederate States of America, with Jefferson Davis as President.

The plotters raided armies, seized forts, arsenals, mints and other Union property. Even members of President Buchanan’s Cabinet conspired to destroy the Union by damaging the public credit and working to bankrupt the nation. Buchanan claimed to deplore secession but took no steps to check it, even when a U.S. ship was fired upon by South Carolina shore batteries.

Shortly thereafter Abraham Lincoln became President, being inaugurated on March 4, 1861. Lincoln immediately ordered a blockade on Southern ports, to cut off supplies that were pouring in from Europe. The ‘official’ date for the start of the Civil War is given as April 12, 1861, when Fort Sumter in South Carolina was bombarded by the Confederates, but it obviously began at a much earlier date.

In December, 1861, large numbers of European Troops (British, French and Spanish) poured into Mexico in defiance of the Monroe Doctrine. This, together with widespread European aid to the Confederacy strongly indicated that the Crown was preparing to enter the war. The outlook for the North, and the future of the Union, was bleak indeed.

In this hour of extreme crisis, Lincoln appealed to the Crown’s perennial enemy, Russia, for assistance. When the envelope containing Lincoln’s urgent appeal was given to Czar Nicholas II, he weighed it unopened in his hand and stated: “Before we open this paper or know its contents, we grant any request it may contain.”

Unannounced, a Russian fleet under Admiral Liviski, steamed into New York harbor on September 24, 1863, and anchored there. The Russian Pacific fleet, under Admiral Popov, arrived in San Francisco on October 12. Of this Russian act, Gideon Wells said: “They arrived at the high tide of the Confederacy and the low tide of the North, causing England and France to hesitate long enough to turn the tide for the North” (Empire of “The City,” p. 90).

History reveals that the Rothschilds were heavily involved in financing both sides in the Civil War. Lincoln put a damper on their activities when, in 1862 and 1863, he refused to pay the exorbitant rates of interest demanded by the Rothschilds and issued constitutionally-authorized, interest free United States notes. For this and other acts of patriotism Lincoln was shot down in cold-blood by John Wilkes Booth on April 14, 1865, just five days after Lee surrendered to Grant at Appamattox Court House, Virginia.

Booth’s grand-daughter, Izola Forrester, states in This One Mad Act that Lincoln’s assassin had been in close contact with mysterious Europeans prior to the slaying, and had made at least one trip to Europe. Following the killing, Booth was whisked away to safety by members of the Knights of the Golden Circle. According to the author, Booth lived for many years following his disappearance.

International Bankers Pursue Their Goal

Undaunted by their initial failures to destroy the United States, the international bankers pursued their objective with relentless zeal. Between the end of the Civil War and 1914, their main agents in the United States were Kuhn, Loeb and Co. and the J. P. Morgan Co..

A brief history of Kuhn, Loeb and Co. appeared in Newsweek magazine on February 1, 1936:

“Abraham Kuhn and Solomon Loeb were general merchandise merchants in Lafayette, Indiana, in 1850. As usual in newly settled regions, most transactions were on credit. They soon found out that they were bankers... In 1867, they established Kuhn, Loeb and Co., bankers, in New York City, and took in a young German immigrant, Jacob Schiff, as partner. Young Schiff had important financial connections in Europe. After ten years, Jacob Schiff was head of Kuhn, Loeb and Co., Kuhn having retired. Under Schiff’s guidance, the house brought European capital into contact with American industry.”

Schiff’s “important financial connections in Europe” were the Rothschilds and their German representatives, the M. M. Warburg Company of Hamburg and Amsterdam. Within twenty years the Rothschilds, through their Warburg-Schiff connection, had provided the capital that enabled John D. Rockefeller to greatly expand his Standard Oil empire. They also financed the activities of Edward Harriman (Railroads) and Andrew Carnegie (Steel).

At the turn of the 20th century the Rothschilds, not satisfied with the progress being made by their American operations, sent one of their top experts, Paul Moritz Warburg, over to New York to take direct charge of their assault upon the only true champion of individual liberty and prosperity – the United States.

At a hearing of the House Committee on Banking and Currency in 1913, Warburg revealed that he was “a member of the banking firm of Kuhn, Loeb and Co. I came to this country in 1902, having been born and educated in the banking business in Hamburg, Germany, and studied banking in London and Paris, and have gone all around the world….“

In the late 1800s, people didn’t study banking in London and “all around the world” unless they had a special mission to perform!

Jacob H. Schiff

Early in 1907, Jacob Schiff, the Rothschild-owned boss of Kuhn, Loeb and Co., in a speech to the New York Chamber of Commerce, warned that “unless we have a Central Bank with adequate control of credit resources, this country is going to undergo the most severe and far reaching money panic in its history.“

Shortly thereafter, the United States plunged into a monetary crisis that had all the earmarks of a skillfully planned Rothschild ‘job.’ The ensuing panic financially mined tens of thousands of innocent people across the country – and made billions for the banking elite. The purpose for the ‘crisis’ was two-fold:

1) To make a financial ‘killing’ for the Insiders, and

2) To impress on the American people the ‘great need‘ for a central bank.

Paul Warburg told the Banking and Currency Committee: “In the Panic of 1907, the first suggestion I made was, ‘let us have a national clearing house’ [Central Bank]. The Aldrich Plan [for a Central Bank] contains many things that are simply fundamental rules of banking. Your aim must be the same….“

Digging deep into their bag of deceitful practices, the international bankers pulled off their greatest coup to date – the creation of the privately owned Federal Reserve System, which placed control of the finances of the United States securely in the hands of the power-crazed money monopolists. Paul Warburg became the ‘Fed’s’ first chairman!

Congressman Charles Lindbergh put his finger firmly on the truth when he stated, just after the ‘Federal’ Reserve Act was passed by a depleted Congress on December 23, 1913: “The Act establishes the most gigantic trust on earth. When the President [Wilson] signs this Bill, the invisible government of the monetary power will be legalized….The greatest crime of the ages is perpetrated by this banking and currency bill.“

Jewish Idea Molded Federal Reserve Plan

The last remembrance of Paul M. Warburg was as “an alien not naturalized” secretly closeted with Senator Nelson W. Aldrich and a party of bankers on an obscure island off the southeastern coast of the United States, all the members of the party concealing their identity even from the servants by calling each other by their first names.

Paul M. Warburg

That conference in its ultimate results was of the utmost importance to the United States, for then and there were formulated those fiscal devices, those financial methods, those “monetary reforms” which have exerted an influence on every citizen, rich and poor, of the Republic.

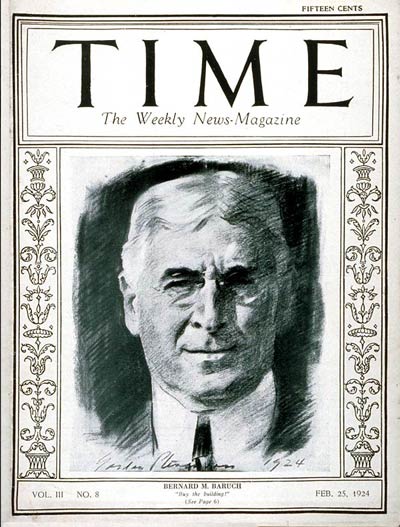

Much history was made in that little trip. It irresistibly calls to memory that other trip made in 1915 – almost two years before America’s entry into the war – by Bernard M. Baruch. As long-time listeners of Perspectives on America, will recall, Mr. Baruch had been financial backer of the Plattsburg camp (and would soon become the backer for Winston Churchill, who together would be involved with the plunging of the US Stock Markets some 14 years later), and in his testimony he said he thought that General Wood would admit this. Then – “I went off on a long trip, and it was while on this trip that I felt there ought to be some mobilization of the industries, and I was thinking about the scheme that practically was put into effect and was working when I was chairman of the board. When I came back from that trip I asked for an interview with the President . . . . The President listened very attentively and graciously as he always does.” Mr. Baruch was an authority on the President’s demeanor, for there was a long period in 1917 and 1918 during which he called at the White House every afternoon.

Two momentous trips in our recent history, both of them signalized and given their principal meaning by the presence of Jews. Not that there should not have been Jews in either case; to insist upon their total exclusion would be going too far. The Jew as a citizen, bearing his part, is one matter; the Jew as a master, directing the national show, is quite another thing. It is by no means agreed that Barney Baruch was the only man in the United States who could have run this nation’s war business. That is the explanation made of the high place he took – that he was the only man who could do it. Nonsense! If that be so, let us close up the nation and hand the keys over to the New York Kehillah. Mr. Baruch could say – “I probably had more power than any other man did in the war; doubtless that is true,” but he had that power because he was for the time the head and front of the Jewish group for war purposes.

If the explanation of Jewish mastery at critical moments were “brains,” well and good, but if it were, it would be more evident to the people; brains do not need to be advertised, they advertise themselves. There is another reason.

The British public had recently awoke to the fact that not Lloyd George but Mr. Montagu and Sir Alfred Mond were in charge of the recent negotiations over the German indemnities. These gentlemen are both Jews, one of them of German descent. Of all the British Empire are they the only two men to advise the premier in a great crisis? If they are, why is it? The Montagu’s, we know, control the silver of the world; Sir Alfred Mond, we know, turned a very neat trick of keeping the sign of the Cross off the war memorials raised to the soldiers of the empire; their Jewishness always so apparent. Both financiers; both the close advisers of the premier; as Baruch to Wilson, so they to Lloyd George.

Apparently there are no Anglo-Saxons on either side of the sea capable of managing these deep matters, if we are to judge from the war administrations — those that have passed off the stage and those that still linger. Lloyd George, for once stung to the quick by the criticism of the British public of his tendency to closet himself with Jews when confronted with a crucial question, retorted bitterly – with what? With the old outworn Jewish propagandist boast, that it ill became people who sang Jewish psalms in church to rag the race that wrote them! A most illuminating defense! The world would give a good deal for a true psalm from Sir Alfred Mond, Mr. Montagu, or even Sir Philip Sassoon, who is soon to become the premier’s son-in-law.

In our own history, Barney Baruch boldly claimed his place, he unhesitatingly asserted at he had more power than any man in the war. If Allenby in Palestine needed a locomotive, if the Americans in Russia needed clothing, if the munition mills needed copper – it was Baruch who gave or withheld the word.

Mr. Warburg, being of somewhat finer grain, probably due to his having less than Mr. Baruch of the rough experience of “the Street,” did not make the claim that he is the chief factor in the present monetary system of the United States, nor do we undertake to make it for him lest the cry of “anti-Semitism” wax wrathful again; but fortunately the fact is amply attested by a Jew whose knowledge of the matter is unquestionable.

Listeners have doubtless become aware by this time that for a non-Jew to say that a certain Jew is a most important factor in any field is to be guilty of anti-Semitism, while for a Jew or a “Gentile front” to say it is perfectly proper. It is a rather odd etiquette in which simple minds sometimes become confused.

Professor E. R. A. Seligman, of Columbia University, was the sponsor of this great honor for Mr. Warburg. What Professor Seligman said was of such importance, both as to its source and its subject, that quotation is justified:

“It is in a general way known to the public that Mr. Warburg was in some way connected with the passage of the Federal Reserve Act, and his appointment to his present responsible position on the Federal Reserve Board was acclaimed on all sides with a rare degree of approval and congratulation; but I fancy it is known only to a very few how great is the indebtedness of the United States to Mr. Warburg. For it may be stated without fear of contradiction that in its fundamental features the Federal Reserve Act is the work of Mr. Warburg more than of any other man in the country . . . .

“When the Aldrich commission was appointed it was not long before Senator Aldrich – to his credit be it said – was won over by Mr. Warburg to the adoption of these two fundamental features. The Aldrich Bill differed in some important particulars from the then present law . . . . The concession in the shape of the twelve regional banks that had to be made for political reasons is, in the opinion of Mr. Warburg as well as of the writer of this introduction, a mistake; for it probably, to some extent at least, weakened the good results which would otherwise have followed. On the other hand, the existence of a Federal Reserve Board created, in everything but in name, a real central bank; and it depends largely upon the wisdom with which the board exercises its great powers as to whether we shall be able to secure most of the advantages of a central bank without any of its dangers . . . .

“In many minor respects also the Federal Reserve Act differs from the Aldrich Bill; but in the two fundamentals of combined reserves and of a discount policy, the Federal Reserve Act has frankly accepted the principles of the Aldrich Bill; and these principles, as has been stated, were the creation of Mr. Warburg and of Mr. Warburg alone.

“. . . . It must not be forgotten that Mr. Warburg had a practical object in view. In formulating his plans and in advancing slightly varying suggestions from time to time, it was incumbent on him to remember that the education of the country must be gradual and that a large part of the task was to break down prejudices and remove suspicions. His plans, therefore contain all sorts of elaborate suggestions designed to guard the public against fancied dangers and to persuade the country that the general scheme was at all practicable. It was the hope of Mr. Warburg that with the lapse of time it might be possible to eliminate from the law not a few clauses which were inserted, largely at his suggestion, for educational purposes.

“As it was my privilege to say to President Wilson when originally urging the appointment of Mr. Warburg on the Federal Reserve Board, at a time when the political prejudice against New York bankers ran very high, England also, three-quarters of a century ago, had a practical banker who was virtually responsible for the idea contained in Peel’s Bank Act of 1840. Mr. Samuel Jones Lloyd was honored as a consequence by the British Government and was made Lord Overstone. The United States was equally fortunate in having with it a Lord Overstone . . . .

“The Federal Reserve Act will be associated in history with the name of Paul M. Warburg . . . .” ~ (pp. 387-390, Vol. 4, No. 4, Proceedings of the Academy of Political Science, Columbia University).

It surely cannot be considered invidious for this program thus to introduce to the people of the United States a gentleman whose influence upon the country is so vital. Just how vital can be understood only by those who have studied the puzzle of a country filled with the good things of life, and still unable to use them or to share them because of a kink in the pipe line called “money.”

But that Mr. Warburg himself was not entirely unaware of his position is indicated on page 56 of his testimony quoted last week. Mr. Warburg had just told the Senate Committee that he was making a heavy financial sacrifice to accept the position on the Federal Reserve Board offered him by President Wilson, and into the fitness of which appointment the Senate was carefully inquiring:

Senator Reed – “May I ask what your motive is, or your reason for making that sacrifice?”

Mr. Warburg – “My motive is that I have, as you know, taken a keen interest in this monetary reform since I have been in this country.

“I have had the success which comes to few people, of starting an idea and starting it so that the whole country has taken it up and it has taken some tangible form.”

Professor Seligman advises us of the strategy that was used to get the whole country to take up Mr. Warburg’s idea, and of the fact that some of the items inserted to appease the public might easily be removed when the public shall have become accustomed to Mr. Warburg and the Federal Reserve Board; but Mr. Warburg adds another hint, to the effect that you can do some things by administration which you cannot do by organization.

For example: Mr. Warburg wanted only one central bank which should be the sole arbiter of finance in the United States. The United States Government would have almost nothing to do save to make the money and stand back of it; the bankers of the United States, and the people thereof, would have nothing to do except what they were told; the one central bank would be the real financial governing authority.

When asked by Senator Bristow to state the fundamental difference between the Aldrich plan and the present Federal Reserve plan, Mr. Warburg replied:

“Well, the Aldrich Bill brings the whole system into one unit, while this deals with 12 units and unites them again into the Federal Reserve Board. It is a little bit complicated, which objection, however, can be overcome in an administrative way; and in that respect I freely criticized the bill before it was passed.”

There is evidently, then, a method of administration for which severe critics might even use the word “manipulation,” by which the plain provisions of a banking law, whatever they may be, may be, if not evaded, then somewhat adapted.

This idea was brought to mind by a more colloquial expression of Mr. Warburg’s to be found in his address on “bank acceptances” delivered in 1919:

“In this connection I am reminded of a story I once heard concerning a man belonging to a species now soon to be extinct and to be found by our children in Webster’s dictionary only, the ‘bartender.’ A man of this profession, in pre-historic times, was abandoning his position and was turning over his cash-register to his successor. ‘Please show me how it works,’ said the newcomer. ‘I will show you how it works,’ said the other, ‘but I won’t show you how to work it.'”

The politics of Mr. Warburg and the firm of Kuhn, Loeb & Company formed part of the inquiry, and Mr. Warburg made some interesting revelations which illustrate the oft-repeated statement that it is part of Jewish policy – perhaps of large financial firms generally – to attach themselves to both parties so that certain interests may be the winners regardless of which party is defeated.

Senator Pomerene – “What are your politics?“

Senator Nelson – “No; we have not raised that before this committee.“

Senator Reed – “It has not been raised here, but I should like to know.“

Senator Pomerene – “It has been raised before the Senate.“

Senator Reed – “I will say why I should like to know.“

Senator Pomerene – “Well, I have no objection to saying what was in my own mind.“

The Chairman – “I will say that I do not know what Mr. Warburg’s politics are.“

Senator Pomerene – “Well, I did not.“

Senator Shafroth – “I do not know and I do not care to know.“

Senator Pomerene – “I heard the statement made that the entire board was Democratic, and I had understood that Mr. Warburg was a Republican, or had been, in his affiliations.“

Mr. Warburg – “Well, so I was; and my sympathies were entirely, in the early campaign, for Mr. Taft against Mr. Roosevelt in the first fight. When later on Mr. Roosevelt became President Wilson’s opponent my sympathies went with Mr. Wilson . . . .“

Senator Reed – “Well, you would count yourself a Republican, generally speaking?“

Mr. Warburg – “I would.”

Senator Bristow – “It has been variously reported in the newspapers that you and your partners directly and indirectly contributed very largely to Mr. Wilson’s campaign funds.“

Mr. Warburg – “Well, my partners – there is a very peculiar condition – no; I do not think any one of them contributed largely at all; there may have been moderate contributions. My brother, for instance, contributed to Mr. Taft’s campaign.“

Senator Bristow – “Just what would you consider a moderate contribution to a presidential campaign?“

Mr. Warburg – “Well, that depends who the man is who contributes; but I think anything below $10,000 or $5,000 would not be an extravagant contribution, so far as that should be – “

(Examination resumed another day)

Senator Bristow – “Now, Mr. Warburg, when we closed Saturday some Senator asked you in regard to political contributions, and I understood you to say that you contributed to Mr. Wilson’s campaign.“

Mr. Warburg – “No; my letter says that I offered to contribute; but it was too late. I came back to this country only a few days before the campaign closed.”

Senator Bristow – “So that you did not make any contribution?“

Mr. Warburg – “I did not make any contribution; no.”

Senator Bristow – “Did any members of your firm make contributions to Mr. Wilson’s campaign?“

Mr. Warburg – “I think that is a matter of record. Mr. Schiff contributed. I would not otherwise discuss the contributions of my partners, if it was not a matter of record. I think Mr. Schiff was the only one who contributed in our firm.“

Senator Bristow – “And you stated that your brother had contributed to Mr. Taft’s campaign, as I understand it?“

Mr. Warburg – “I did. But again, I do not want to go into a discussion of my partners’ affairs, and I shall stick to that pretty strictly, or we will never get through.“

Senator Bristow – “I understood you also to say that no members of your firm contributed to Mr. Roosevelt’s campaign.“

Mr. Warburg – “I did not say that.“

Senator Bristow – “Oh! Did any members of the firm do that?“

Mr. Warburg – “My answer would please you probably; but I shall not answer that, but will repeat that I will not discuss my partners’ affairs.“

Senator Bristow – “Yes. I understood you to say Saturday that you were a Republican, but when Mr. Roosevelt became a candidate, you then became a sympathizer with Mr. Wilson and supported him?“

Mr. Warburg – “Yes.“

Senator Bristow – “While your brother was supporting Mr. Taft?”

Mr. Warburg – “Yes.”

Senator Bristow – “And I was interested to know whether any member of your firm supported Mr. Roosevelt.”

Mr. Warburg – “It is a matter of record that there are.“

Senator Bristow – “That there are some of them who did?“

Mr. Warburg – “Oh, yes.“

Senator Bristow – “Will you please indicate – or do you care to indicate – what members of your firm supported Mr. Roosevelt in that campaign?“

Mr. Warburg – “No, sir; I shall have to go on the principle that I cannot disclose the business of a member of my firm.“

The result was this: that in a three-cornered fight between three candidates, Roosevelt, Taft and Wilson, the men who constituted the firm of Kuhn, Loeb, & Company, chief Jewish financial institution of the United States, distributed their support among all three. Schiff for Wilson; Felix Warburg for Taft; and an unknown for Roosevelt — was that unknown Mr. Kahn? In any case, Wilson won, and the above examination relates to a member of the firm of Kuhn, Loeb & Company receiving an important appointment that gave him large power over the finances of the United States.

The point of not discussing the affairs of Kuhn, Loeb & Company was frequently made by Mr. Warburg.

“I cannot discuss the affairs of the firm nor my partners, nor be asked to criticize acts of my partners, either to approve them or in any other way. I would like to say that before we come to the point where I would feel that I should not answer any question,” said Mr. Warburg.

The principle of this objection was conceded by the Senate Committee, but that it ought to serve as a blanket injunction against a number of pertinent inquiries was doubted.

Senator Bristow – “But you are a partner in this firm, and have you not had something to do with its operations and its management?“

Mr. Warburg – “Yes.“

Senator Bristow – “Does that not go to show your general views and practices as a financier and as a citizen and as a business man?“

Mr. Warburg – “Yes; but you have got to take them individually. . . . I cannot permit my firm to be drawn into this discussion.“

Senator Bristow – “But how can you divest yourself from your firm when you have been one of the managers of the firm?“

Mr. Warburg – “I shall divest myself of the firm.”

Senator Bristow – “If the firm has done something that I might think was improper – to illustrate, being called upon to say whether or not I approve your nomination to this responsible position – have I not a right to know what your attitude was in regard to that transaction which your firm performed?“

Mr. Warburg – “Well, inasmuch as my answer there might be a criticism of my firm, I would beg to be excused, and I would leave it to the committee to draw its own conclusions. . . .“

In examining Mr. Warburg about the handling of $100,000,000 Southern Pacific securities, the same difficulty was experienced; Mr. Warburg objected, “but we are getting here again into the transactions of my firm!”

To which Senator Bristow retorted – “Ah! but when you participated in the profits of the transaction, is it not a part of your business life?“

Mr. Warburg – “Certainly it is a part of my business life, and there is no reason why I should not be proud of it. But as a matter of principle I think we should not get into a discussion of the business of my firm.”

Senator Bristow – “I am discussing your business.“

Mr. Warburg – “No, you are discussing the firm’s business.“

Senator Bristow – “Did you get any of the profits that came from the handling of this $100,000,000?“

Mr. Warburg – “You may take it that whatever my firm did I got my profits – my share in the profits.“

Senator Bristow – “Your share in the profits. Now, without being specific, I take it for granted that this was quite material; that that was quite a material interest in size; that is, that you are one of the important members of the firm.”

Mr. Warburg – “I am one of the important members of the firm.”

Senator Bristow – “Yes, I think the testimony and the report here show that you are the third important member – or the second, which is it? – of the firm“

Mr. Warburg – “We are not numbered.”

Senator Bristow – “You are not; all right.“

Mr. Warburg – “There is Mr. Jacob H. Schiff who is the senior.”

Senator Bristow – “Yes.”

Mr. Warburg – “And the others rank very much alike.”

Senator Bristow – “Yes. We may take it for granted, then, that whatever profits accrued to your firm in the handling of this business here since you became a member of it, you participated in the profits as one of the partners.“

Mr. Warburg – “Yes, sir.”

Senator Bristow – “Yes. So I will assume then, of course, that you participated in the marketing of $113,000,000 of Union Pacific, and so on.”