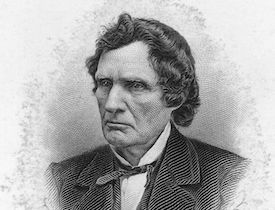

Speech on the Treasury Note Bill, delivered February 6, 1862 in the U.S. House of Representatives

“We believe that the credit of the country will be sustained by it, that under it all classes will be paid in money which all classes can use, and that will confer no advantage on the capitalist over the poor laboring man.”

Thaddeus Stevens

Mr. Stevens: Mr. Chairman, this bill is a measure of necessity, not of choice. No one would willingly issue paper currency not redeemable on demand and make it legal tender. It is never desirable to depart from the circulating medium which, by common consent of civilized nations, forms the standard of value. But it is not a fearful measure; and when rendered necessary by exigencies, it ought to produce no alarm.

The first inquiry then is, is this measure necessary? The late Administration left a debt of about $100,000,000. It bequeathed us also an expensive and formidable rebellion. This compelled Congress, at its extra session, to authorize a loan of $250,000,000 — $100,000,000 of these were taken at seven and three tenths per cent., and $50,000,000 of six per cent. bonds, at a discount of over $5,000,000; $50,000,000 were used in demand notes payable in coin, leaving $50,000,000 undisposed of. Before the banks had paid much of the last loan they broke down under it, and suspended specie payments. They have continued to pay that loan, not in coin, but in demand notes of the Government – that has kept them at par. But the last of that loan was paid yesterday; and on the same day the banks refused to receive them. They must now sink to depreciated currency. The remaining $50,000,000 the Secretary of the Treasury has been unable to negotiate. A small portion of it, say $10,000,000, has been issued at seven and three tenths in payment of debts.

All this has been used; and there is now a floating debt, audited and unaudited, of at least $180,000,000. The Secretary intended to use the balance of the authorized loan by paying it out to creditors in notes of seven and three tenths; that becoming known they immediately sunk four per cent; and if he had persevered it is believed they would have run down to ten per cent discount. But even if these could be used (about $40,000,000) there would remain due about $90,000,000, the payment of which is urgently demanded. The daily expenses of the Government are now about $2,000,000. To carry us on until the next meeting of Congress would take $600,000,000 more, making, before legislation could be had at next session, about $700,000,000 to be provided for. We have already appropriated $350,000,000 – making our entire debt $1,050,000,000.

The grave question is, how can this large amount be raised? The Secretary of the Treasury has used his best efforts to negotiate a loan of but $50,000,000, and has failed. Several modes of relief have been suggested; the most obvious is to borrow on Government bonds, bearing an interest of six per cent. That it is known can only be effected by putting the bonds into the market to the highest bidder. If but a small sum were wanted it might probably be had at a small discount. But if sufficient to meet our wants up to next December, or $700,000,000, were forced into the market, as is wanted, I have no doubt they would sell as low as sixty percent, as in the last English war (the Crimean War); and even then it would be found impossible to find payment in coin. A large part of it must be accepted in the depreciated notes of non-specie paying banks, for I suppose no one expects the resumption of specie payments until the war shall be ended. But as this Congress must provide for appropriations to the end of the fiscal year 1863, seven months more must be added to these $700,000,000 before estimated, and the aggregate would be $1,100,000,000. The discount on that sum at forty percent would be $440,000,000. At the minimum discount that any reasonable man could fix, say twenty-five percent, it would be $275,000,000. It would, therefore, require at least bonds to the amount of $1,500,000,000 to produce sufficient currency to make $1,100,000,000, and carry us to the end of the next fiscal year. This sum is too frightful to be tolerated.

Certain bankers have suggested that the immediate wants of the Government might be supplied by pledging seven and three tenths percent bonds with a liberal margin, payable in one year, to the banks, who would advance a portion in gold and the rest in currency. The effect would be that the Government would pay out to creditors the depreciated notes of non-specie paying banks. And as there is no probability that the pledges would be redeemed when due, they would be thrown into the market and sold for whatever the banks might choose to pay for them. The folly of this scheme needs no illustration.

Another is to strike out the legal tender clause, and make receivable for all taxes and public dues; but it is not proposed to make any provision for redeeming them in coin on demand. I do not believe such notes would circulate anywhere except at a ruinous discount. No notes not redeemable on demand, and not made a legal tender, have ever been kept at par. Even those who could use them for taxes and duties would discredit them that they might get them low. If soldiers, mechanics, contractors, and farmers, were compelled to take them from the Government, they must submit to a heavy shave before they could use them. The knowledge that they were provided for by taxation, and would surely be paid twenty years hence, would not sustain them.

The Secretary of the Treasury, in his report, recommended a scheme to produce a uniform national currency, and furnish a market for Government bonds. It proposes that the banks shall receive their circulation from the Government to the amount of Government bonds pledged, with the Treasury for their security; and that no more notes should be issued than the par value of such bonds, and should be redeemed by the banks. As a general system of banking in ordinary times, it might be very useful in regulating the currency, and by the sale of the bonds the Government might command coin. But while the banks are in suspension, it is not easy to see how it would relieve the Government. If the notes were procured it must be by accepting payment by the Government in depreciated circulation. How would that be any better than the Government’s own notes? The security of the Government is equal to that of the banks, and would give as much currency. To the banks I can see its advantage. They would have the whole benefit of the circulation without interest, and at the same time would draw interest on the Government bonds from the time they got the notes. Now, it is very plain that, if the United States issued those notes direct, they would have the benefit of the whole circulation. In other words, it would be equal to a loan, without interest, to the full amount of the circulation. This project, therefore, however desirable as a banking system, could afford no immediate relief, especially as it would afford no sale for additional bonds, as the banks have already as many as would form the basis of their operations. Having, as I think, shown the impossibility of carrying on the Government in any other way, let us briefly notice some of the objections to it. First, is it constitutional?

The power to emit bills of credit and make them a legal tender is nowhere expressly given in the Constitution; but it is known that but few of the acts which Government can perform are specified in that instrument. It would require a volume larger than the Pendects of Justinian or the Code Napoleon to make such enumeration, whereas our Constitution has but a few pages. But everything necessary to carry out the granted powers of the Government is not only implied but expressly given to Congress. If nothing could be done by Congress except what is enumerated in the Constitution, the Government could not live a week.

The States are prohibited from making anything but “gold and silver coin a tender in the payment of debts;” but such prohibition does not extend to Congress. The Constitution is silent as to the power of Congress over that subject. The whole question of the right to emit bills of credit by Congress was considered in the convention that framed the Constitution. It was reported as a part of the power to “borrow money.” It was objected to as tending to make paper a currency with legal tender, and a motion was made to strike it out and insert and express prohibition. That was resisted, because, as Mr. Mason said, “it could not be foreseen what the necessities of the Government might at some time require.” “The late war,” he said, “could not have been carried on had such prohibition existed.” It was finally agreed to strike out the express power, and not to insert the prohibition, leaving it to the exigencies of the times to determine its necessity. The right to emit bills of credit, which convention expressly refused to grant as a substantive power, has for fifty year, by the common consent of the nation, been practiced, and is now conceded by every opponent of this bill. With what grace can the concomitant power to make them a legal tender be objected to? The Supreme Court have settled certain principles with regard to the power of Congress over measures not expressly enumerated in the Constitution. The principle is, that where anything is necessary to carry into effect the granted power it is constitutional. The eighth section of the first article of the Constitution gives Congress power –

“To make all laws which may be necessary and proper to carry into execution the foregoing powers, and all other powers vested by this Constitution in the United States or any department or officer thereof.”

The Constitution nowhere gives Congress power to create corporations or to establish a bank of the United States. But as Congress had power to regulate commerce, and to regulate the value of coin, and it deemed the establishment of a bank necessary to effectuate those powers, the Supreme Court pronounced it constitutional. In short, whenever any law is necessary and proper to carry into execution any delegated power, such law is valid. That necessity need not be absolute, inevitable, and overwhelming – if it be useful, expedient, profitable, the necessity is within the constitutional meaning. Whether such necessity exists is solely for the decision of Congress. Their judgment is absolute and conclusive. If Congress should decide this measure to be necessary to a granted power, no department of the Government can rejudge it. The Supreme Court might think the judgment of Congress erroneous, but they could not review it. Now, it is for Congress to determine whether this bill is necessary “to raise and support armies and navies, to borrow money, and provide for the general welfare.” They are all granted powers. It is for those who think that it is not “necessary, useful, proper,” to propose some better means, and vote against this; if a majority think otherwise, its constitutionality is established.

If constitutional, is it expedient? It is objected by the gentleman from Ohio that the legal tender clause would depreciate the notes. All admit the necessity of the issue. But some object to their being made money. It is not easy to perceive how notes issued without being made immediately payable in specie can be made any worse by making them a legal tender. And yet that is the whole argument so far as expediency is concerned. Other gentlemen argued that this would impair contracts by making debt payable in other money than that which existed at the time of the contract, would so be unconstitutional. Where do the gentlemen find any prohibition on Congress against passing laws impairing contracts? There is none, though it would be unjust to do it. But this impairs no contract. All contracts are made not only with a view to present laws, but subject to future legislation of the country. We have more than once changed the value of coin. Neither our gold or silver coin is as valuable as it was fifty years ago. Congress in 1853, I believe, regulated the weight and value of silver. They debased it over seven per cent and made it legal tender. Whoever pretended that that was unconstitutional? The gentleman for Vermont (Mr. Morrill) and Ohio (Mr. Pendleton) think it an ex post facto law. It is not wonderful that my distinguished colleague, not being a professional lawyer, should not be aware that the ex post facto laws prohibited by the Constitution refer only to crimes and misdemeanors, and not to civil contracts. The gentleman from Ohio no doubt knew but forgot it.

It is said that this will inflate the currency and thus raise the price of commodities and stimulate speculation. How do gentlemen expect that using the same amount of notes without the legal tender will inflate it less? It will take the same amount of millions, with or without the legal tender, to carry on the war, except that the one would be below par and the other at par. No instance can be given of a currency not redeemable on demand in gold that did not immediately depreciate. But if made a legal tender, and not a redundancy of it emitted, it will be par. I fear gentlemen have not well consulted standard writings on the subject, but have substituted their own fancy and wild declamation.

McMulloch, one of the most learned of writers on that subject, days:

“But though the condition that they shall be paid on demand, with the belief that this condition shall be complied with, will be necessary to sustain the value of notes issued by private parties or associations, it is not necessary to sustain the value of paper money, properly so called, or of notes which have been made a legal tender. The only thing required to sustain the value of the latter description of currency is that it should be issued in limited quantities.”

“Every country has a certain number of exchanges to make; and whether these are affected by the employment of a given number of coins of a particular denomination, or by the employment of the same number of notes of the same denomination, is, in this respect, of no importance whatever. Notes which have been made legal tender, and are not payable on demand, do not circulate because of any confidence placed in the capacity of the issuers to retire them; neither do they circulate because they are of the same real value as the commodities for which they are exchanged; but they circulate because, having been selected to perform the functions of money, they are, as such, readily received by all individuals in payment of their debts. Notes of this description may be regarded as a sort of tickets or counters to be used in computing the value of property, and in transferring it from one individual to another. And as they are nowise affected by fluctuations of credit, their value, it is obvious, must depend entirely on the quantity of them in circulation as compared with the payments to be made through their instrumentality, or the business they have to perform.”

The value of legal tender notes depends on the amount issued compared with the business of the country. If a less quantity were issued than the usual and needed circulation they would be more valuable than gold.

“By reducing the supply of notes below the supply of coin that would circulate in their place were they withdrawn their value may be raised above the value of gold, while by increasing them to a greater extent it is proportionally lowered… There cannot, however, be the least difference, as respects value, in the provinces, between Bank of England paper, now that it is legal tender, and gold.”

Mr. Thomas, of Massachusetts. I desire to ask the gentleman a question in connection with that passage. McCulloch laid down the doctrine that the paper is limited to the amount necessary for currency. Let me ask the gentleman from Pennsylvania whether he now expects, in managing these financial matters, to limit the amount of these notes to $150,000,000? Is that his expectation?

Mr. Stevens. It is. I expect that is the maximum amount to be issued.

Mr. Thomas. You do not expect to call for any more?

Mr. Stevens. No, sir; I do not.

Increase gold and silver beyond the amount needed, and you depreciate its value. Such inflation of the currency is just as injurious as if it were in paper, so far as raising prices and stimulating speculation are concerned.

I know the danger of granting to irresponsible institutions or individuals the right to issue paper currency not immediately convertible, because their avarice would always abuse the privilege and over issue. But when the Government thus issues, the fault and the crime is theirs if they do not restrain it within proper bounds. Is the proposed issue of $150,000,000 too much? It is believed the ordinary business of country, especially now, requires a circulation of $400,000,000. The bank circulation has been about $200,000,000, with coin to the amount of $250,000,000. The bank paper, now in suspension, would largely disappear before this par paper; and during suspension, which means during the war, there will be but little coin circulation. If the whole $150,000,000 of United States notes could be kept circulating, I do not think the surviving bank paper would furnish a sufficient currency for commercial purposes – some coin must be added. But it is not probable that it could all be kept out; much would rest in banks, in the pockets of private individuals, or await investment temporarily, at least, for awhile.

But my distinguished colleague from Vermont (Mr. Morrill) fears that enormous issues would follow to supply the expenses of the war. I do not think any more would be needed than the $150,000,000. The notes bear no interest. No one would seek them for investment. In the rapid circulation of money, $100 in a year is turned so often as to purchase ten items in value. This money would soon lodge in large quantities with the capitalists and banks, who must take them. But the instinct of gain, perhaps I may call it avarice, would not allow them to keep it long unproductive. A dollar in a miser’s safe unproductive is a sore disturbance. Where could they invest it? In United States loans at six per cent, redeemable in gold in twenty years, the best and most valuable permanent investment that could be desired. The Government would thus again possess such notes in exchange for bonds, and again reissue them. I have no doubt that thus the $500,000,000 of bonds authorized would be absorbed in less time than would be needed by Government; and thus $150,000,000 would do the work of $500,000,000 of bonds. When further loans are wanted, you need only authorize the sale of more bonds; the same $150,000,000 of notes will be ready to take them.

I contend that this currency will be better than any this country can produce. Bank notes are merely local. The holder of them in St. Louis, wishing to transmit to New York, must pay a discount of from one to ten per cent. If he has gold, the cost of transportation is considerable. If he travel, it is cumbersome. But if he has United States par notes, he can send them without cost all over the Union.

Gentlemen are clamorous in favor of those who have debts due them, lest the debtor should the more easily pay his debt. I do not much sympathize with such importunate money-lenders. But widows and orphans are interested, and in tears lest their estates should be badly invested. I pity no one who has his money invested in United States bonds, payable in gold in twenty years, with interest semi-annually.

But while these men have agonized bowels over the rich man’s case, they have no pity for the poor widow, the suffering soldier, the wounded martyr to his country’s good, who must receive these notes without legal tender or nothing, and who must give half of it to the Shylocks to get the necessities of life. Sir, I wish no injury to any, nor with our bill could any happen; but if any must lose, let it not be the soldier, the mechanic, the laborer, and the farmer.

Let me restate the various projects. Ours proposes United States notes, secured at the end of twenty years to be paid in coin, and the interest, raised by taxation, semi-annually; such notes to be money, and of uniform value throughout the Union. No better investment, in my judgment can be had; no better currency can be invented.

The amendment of the gentleman from Ohio (Mr. Vallandigham) proposes the same issue of notes, but objects to a legal tender; but does not provide for the redemption on demand in coin. He fears our notes would depreciate. Let him who is sharp enough to see it instruct me how notes that every man must take are worth less than the same notes that no man need take, and few would, being irredeemable on demand. But he doubts its constitutionality. He who admits our power to emit bills of credit, nowhere expressly authorized by the Constitution, is a sharp and unreasonable doubter when he denies the power to make them a legal tender.

The proposition of the gentleman from New York (Mr. Roscoe Conkling) authorizes the issuing of seven per cent bonds, payable in thirty-one years, to be sold ($250,000,000 of it) or exchanged for the currency of the banks of Boston, New York, and Philadelphia.

Sir, this proposition seems to me to lack every element of wise legislation. Make a loan payable in irredeemable currency, and pay that in its depreciated condition to our contractors, soldiers, and creditors generally! The banks would issue unlimited amounts of what would become trash, and buy good hard money bonds of the nation. Was there ever such a temptation to swindle?

He further proposes to issue $200,000,000 United States notes, redeemable in coin in one year. Does not the gentleman know that such notes must be dishonored, and the plighted faith of the Government broken? No one believes that we could then pay them, and it would be run down at once. If we are to use suspended notes to pay our expenses, why not use out own? Are they not as safe as bank notes? During the suspension the Government would have the benefit of the whole circulation, without interest until they were funded – that is, the interest of all we could keep out would accrue to the Government. If the $150,000,000 were constantly afloat, it would be a loan to Government, without interest, to that amount, $9,000,000 a year. But if we used the suspended paper of the banks our bonds would bear interest from the instant we got their notes – a good thing for suspended banks. Besides, Government would have the benefit of all the lost and destroyed notes – a considerable item.

Last comes the substitute of the minority of the committee. I look upon it as a curiosity. It proposes to issue United States notes, not legal tender, bearing an interest of three and sixty five hundredths per cent and fundable into seven and three tenths per cent bonds, but not payable on demand, but at the pleasure of the United States. This gives one and three tenths per cent higher interest than our loan, and not being redeemable on demand, would share the fate of non-specie paying notes not a legal tender. But the ingenious minority have invented a kind of currency never before known – a circulation bearing interest. Bonds or notes intended for investments bear interest, but no one expects they will be used as currency; whether in the shape of bonds or notes they will be used as investments, or as pledges on which to procure loans. Suppose a tailor, shoemaker, or other mechanic or laborer, were to take one of these bills, and a week he should wish to use it in market, or store, or elsewhere, he must sit down and calculate the interest on the days he has had it to find its value. This would be rather inconvenient in a frosty day. This currency would make it necessary for every man to carry an arithmetic or interest table with which to gauge the value of the circulating medium. Gentlemen must see how ridiculous, if not impracticable, this scheme is.

Here, then, in a few words lies your choice. Throw bonds at six or seven per cent on the market between this and December, enough to raise at least $600,000,000 – about this sum is already appropriated, $557,000,000 – or issue United States notes, not redeemable in coin, but fundable in specie paying bonds at twenty years; such notes either to be made a legal tender, or to take their chance of circulation by the voluntary act of the people.

I maintain that the highest sum you could sell your bonds at would be seventy five per cent, payable in currency itself at discount. That would produce a loss which no nation or individual doing a large business could stand a year.

I contend that I have shown that such issue, without being made money, must immediately depreciate, and would go on from bad to worse. I flatter myself that I have demonstrated, both from reason and undoubted authority, that such notes, made a legal tender and not issued in excess of the demand, will remain at par and pass all transactions, great and small, at the full value of their face; that we shall have one currency for all sections of the country and for every class of people, the poor as well as the rich.

Some gentlemen are as much frightened as if this were an unwonted apparition, for the first time prowling forth to swallow the rich creditor and nurse the poor debtor. No nation, it is said, has ever tried anything like it.

Let us look at the greatest and wisest commercial nation in the world. In 1797 England was struggling for existence against armed Europe. She needed money, as we do now. She found it impossible to borrow. Gold was likely to leave the country. She passed a law prohibiting the Bank of England from paying coin for her notes until six months after the final ratification of peace. That law remained in force till 1823. It is said she did not make those notes a legal tender. She provided that whoever refused to take them for a debt should have no remedy for its collection; and that a plea of such tender should be a bar to the action. This, I think, is the most stringent legal tender; yet those notes never depreciated to any great extent.

Mr. Vallandigham. Did not they depreciate twenty per cent?

Mr. Stevens. No, sir; at no time after they were made a legal tender did they depreciate twenty per cent.

Mr. Vallandigham. I have the authority of Mr. Canning, which I think is quite as good as that of McCulloch. They were receivable all the time for Government dues.

Mr. Stevens. Yes, sir; but they still run down until they were made a legal tender, and after that they never depreciated a single dollar. Had they been made an absolute tender, they would not have depreciated a farthing. But now, in times of peace, the notes of the Bank of England are a legal tender in all the vast business of that nation, and in every place, except the counter of the bank. What else are Bank of England notes but bills of credit of the Government? Her whole capital consists of Government securities, and her issues are based on that alone. Prussia holds the currency in paper issuable by Government alone, and is always at par. What becomes of the fine spun theories of the opponents of this bill? I think they have distressed themselves very unnecessarily; and yet gentlemen have shown all the contortions, if not the inspirations, of the Sibyl, lest Government should make these notes a uniform currency, rather than leave them to be regulated by sharks and brokers. I look upon the immediate passage of this bill as essential to the very existence of the Government. Reject it, and the financial credit not only of the Government but of all the great interests of the country will be prostrated.

Mr. Chairman, let me say in conclusion that unless this bill is to pass with the legal tender clause in it, it is not desirable to its friends or to the Administration that it should pass at all, and those who think as I do will have to vote against it if it shall be thus mutilated and emasculated. If it is to be defeated, I should be glad if we had the power which they have in the British Parliament – to resign our places on the Committee of Ways and Means and leave it to those who oppose this bill to mature some other measures. So far as I am concerned, I shall be modest enough not to attempt any other scheme. The Committee of Ways and Means have labored in the preparation of this measure anxiously and to the best of their poor abilities. We are not infallible. We do not come near it. I am but poorly qualified for anything of this kind. But we have given it our most anxious consideration, and have consulted those whom we believed to be best qualified to advise us. We have sought to harmonize conflicting views in the substitute which the majority of the committee have prepared, and we hope it will pass. We believe that the credit of the country will be sustained by it, that under it all classes will be paid in money which all classes can use, and that it will confer no advantage on the capitalist over the poor laboring man. If this bill shall pass, I shall hail it as the most auspicious measure of this Congress; if it should fail, the result will be more deplorable than any disaster which could befall us.

Further Study: Lincoln and the Bankers